Over the last 25 years, Yodlee® has been honored to forge alliances with the brightest minds in business and technology. Many of these leaders attended our Engage 2024 Data & Analytics Symposium in Fort Lauderdale, Florida, where we discussed how banking, data, and analytics are changing the face of financial services as we know it.

The Power of Partnership: Pledging to Meet the Moment

Partnership was the theme of this year’s symposium. Yodlee’s President Farouk Ferchichi kicked off Engage 2024 by outlining Yodlee’s commitment to honor our remarkable legacy while orchestrating a verifiable and secure global data ecosystem that adds value to every financial decision made by our customers and their customers. For a recap of Farouk’s presentation, click here.

Winning the Moments That Matter

In the keynote address, Jeannie Walters, CEO of Experience Investigators discussed customer service and the importance of knowing your customer. She relayed that in any relationship, it takes at least 12 positive experiences to overcome one negative one. Really successful brands deliver 22 to 24 positive moments for every negative one.

Delivering positive customer experiences requires addressing three components: mindset, strategy, and discipline.

Mindset involves defining your customer experience mission statement, or North Star, and ensuring that your company is aligned with this mission and is delivering what you’ve promised to your customers. A successful mission statement is concise, and instead of focusing on products, talks about what your customers will do with your products.

Strategy means having a plan and ensuring that everyone in your company knows how to execute it. This calls for knowing your customers and their journey.

Discipline requires making an effort every single day to communicate with colleagues and customers. Successful customer experiences are not based on magic, but missions.

Jeanne noted that sweating the small stuff and thinking about the small ways that we connect to customers matters. By turning up the volume on customer experiences and personalizing even the micro moments, we can build and retain customers’ trust.

Insider Perspectives on the New Era of Data Access

Moderator Yumiko Kato, Head of Product from Yodlee, was joined by panelists Rebecca Mulholland from FDATA North America and Jean-Paul LaClair from FDX to address the current state and future of open banking in the U.S., particularly in light of the upcoming Section 1033 rule from the Consumer Financial Protection Bureau (CFPB). The discussion covered the challenges and benefits of implementing open banking and the importance of standardization, consumer control over financial data, and financial services innovation and partnerships. Rebecca and Jean-Paul highlighted the role of FDATA and FDX in developing industry standards, and encouraged financial services leaders to actively participate in shaping open banking.

How Alternative Data is Reshaping the Credit Lifecycle

Moderator and Yodlee Solutions Consultant Director Jeff Hollander and panelists Dustin DeVincentis from Alumni Services, Ethan Dornhelm from FICO, and Kimberly Gartner from Prism Data, explored the use of alternative data in improving credit decisioning, especially for thin-file and underserved populations. The conversation touched on the global adoption of open banking, the use of AI and machine learning in credit models, and the future of data sources in lending. Panelists agreed that while cashflow data shows the most promise for thin-file and non-prime consumers, there are significant opportunities to use this data in small business lending and across various other segments throughout the credit lifecycle.

Decoding the Immediate and Future Impacts of AI

Om Deshmukh, Head of Data Science and Innovation at Yodlee, discussed how AI’s evolution has impacted various industries along with finance. In 2019, AI was used to automate rote work and play video games among other things. Today, AI is being used to actually create works of art, assist in surgeries, and even drive weekly fashion trends.

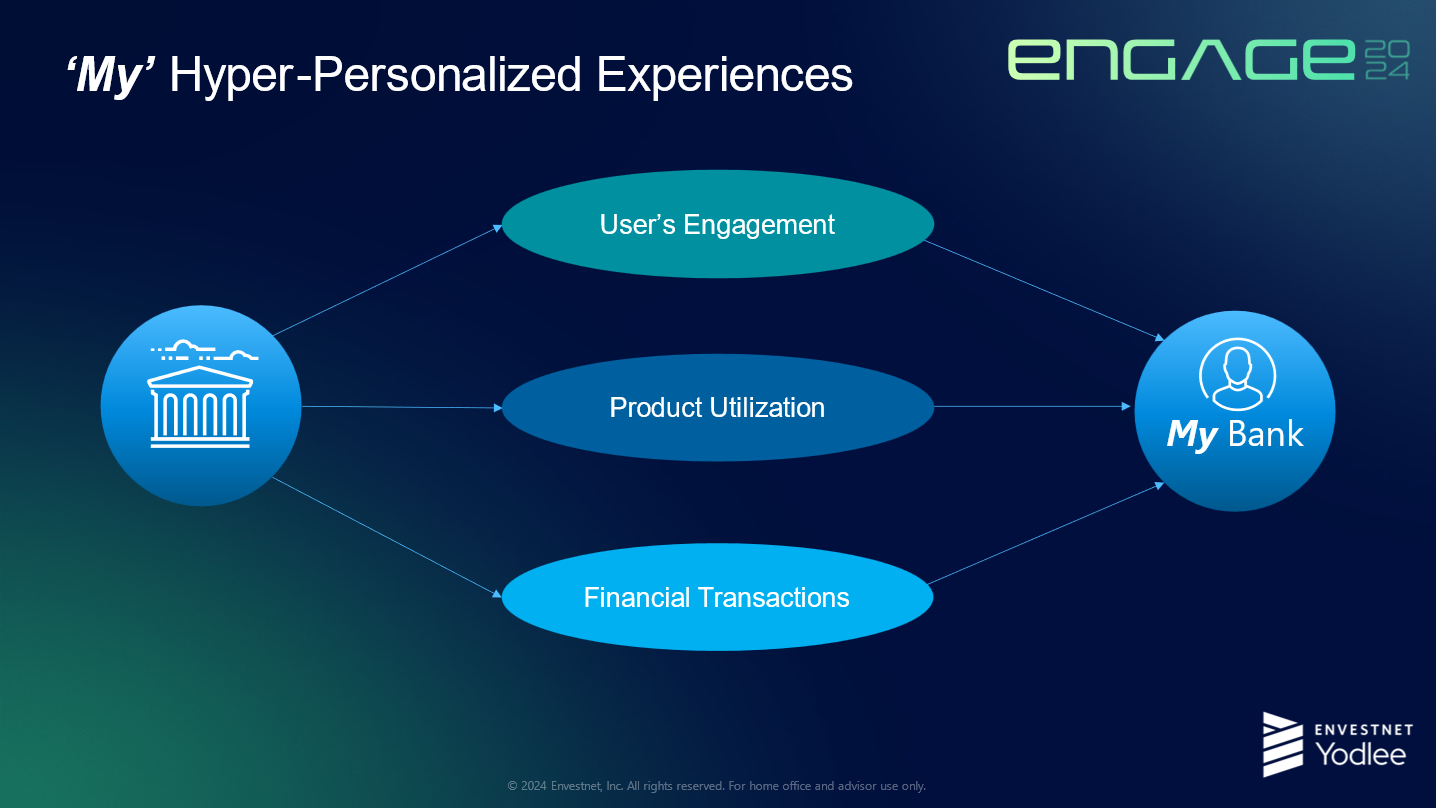

The four main pillars fueling AI and personalization are access to data, open source algorithms, affordable computing power, and natural language interfaces (generative AI). The power of AI is in driving hyper-personalization, turning a universal bank into a “Bank of Me”, which delivers what the user wants, when they want it, in the format that they prefer.

At Yodlee, we’re helping our clients unlock the data needed to deliver these hyper-personal experiences through innovations like our knowledge graph. This graph connects financial data points to enable personalized insights such as individualized inflation impacts, cashflow-based alternative lending data, and cross-sell and upsell opportunities.

As for future developments, AI may advance to the point where financial planning is as effortless as a thought. We’re here to partner with you as that vision becomes reality, ready to navigate these revolutionary changes together.

"At the heart of our journey lies the enduring value of partnership. From the outset, we recognized that true innovation thrives in collaboration. It’s more than just a business tie. It’s a symbolic alliance where your success is entwined without ours. Together, we’ve achieved a remarkable milestone, navigating industries and pioneering solutions.”

– Farouk Ferchichi, President, Yodlee

To learn more about what we discussed at Engage 2024 and see how you can use data and analytics to connect with customers, just reach out.