Pet Industry Sales Declining Post-Pandemic

This analysis explores US pet industry trends across more than 80 brands and shows data suggesting that spending exploded during the pandemic. However, spend has been declining since 2022 with notable deceleration across three spending categories: pet supplies, pet sitting and boarding, and pet care and insurance.

Drawing on Envestnet®| Yodlee®’s de-identified transaction data, we examine year-over-year changes in sales, average sales per transaction, and customer counts for the industry. The data reflects well-known brands including Chewy (CHWY), PetSmart, Petco (WOOF), Pet Supplies Plus, The Farmer’s Dog, Inc., BarkBox, Rover.com (ROVR), Camp Bow Wow, Petsuites, Time To Pet, Canine Country Club, Banfield Pet Hospital, VCA, Trupanion (TRUP), Pets Best Insurance, Healthy Paws, Fetch Inc., PetIQ (PETQ), and Spot Pet Insurance.

Pandemic Peak Followed by Decline

According to the US Pet Market Outlook, the pet industry boomed during the pandemic years and was largely attributed to increased pet ownership and heightened spending per pet.

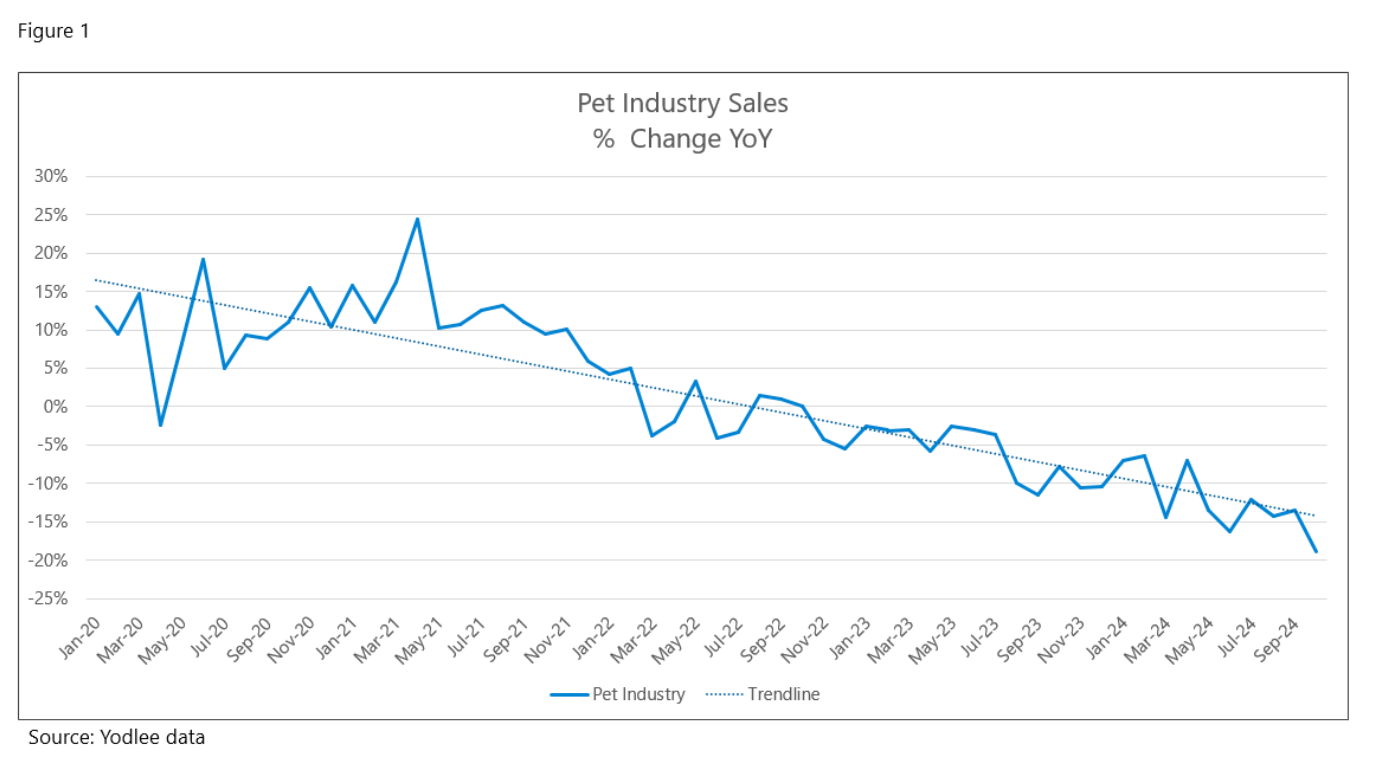

In January 2020, our data suggests that the US pet industry spending was in positive territory (Figure 1). Fluctuation throughout mid-2020 and early 2021 appear to give way to a sharp spike in March 2021, marking the pandemic’s peak spending period. In May 2021, after this surge, spending appears to decelerate steadily accompanied by periodic fluctuations. By September 2024, Yodlee data suggests stabilization, with spending trends beneath January 2020 pre-pandemic levels.

How Spending Varies Across Pet Supplies, Care, and Services

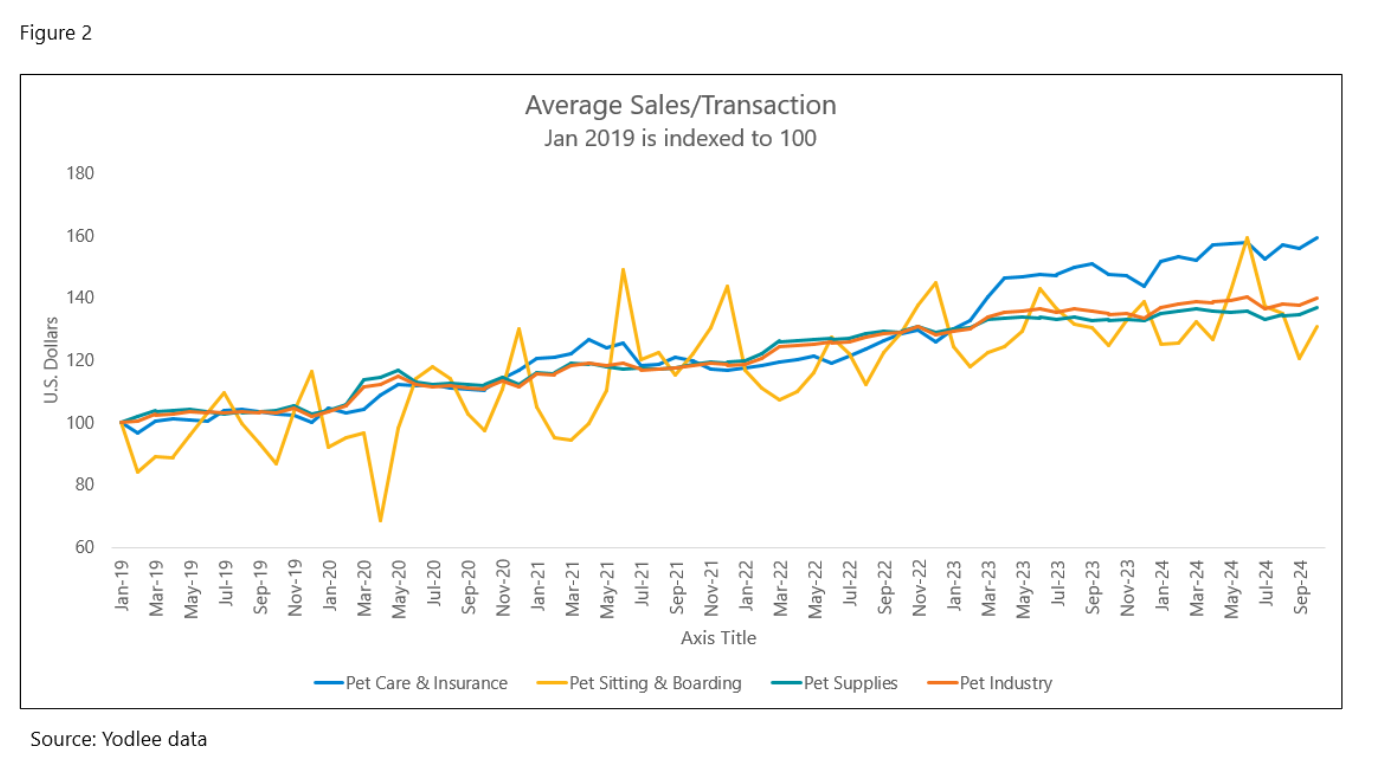

Yodlee data on average sales per transaction offers insights across the pet industry and its three major categories: pet supplies, pet care and insurance, and pet sitting and boarding (Figure 2).

The overall pet industry data suggests a steady rise from January 2019 to September 2024. Pet supplies appear to mirror this trend, reflecting consistent, moderate growth. Pet care and insurance seem to stand out with the most sustained growth, peaking in September 2024. In contrast, pet sitting and boarding appear to be the most volatile, with sharp fluctuations throughout the period.

Sit. Stay. Down? Pet Industry Spending Over 4 Years

Yodlee data analytics reveal trends across the US pet industry’s journey from 2020 to 2024. Transaction values appear to have risen steadily, with pet care and insurance leading in growth, while pet supplies remained stable, and pet sitting and boarding seem to face volatility. User engagement appears to have peaked during the pandemic before tapering off, mirroring broader spending patterns that surged early on and seem to stabilize by 2022. These trends highlight how pet owners adapted their spending behavior during a transformative period for the industry.

Check back in with us to take a closer look at how each category performed.

Want to see how transaction data can inform your investment process?

Learn more about Envestnet | Yodlee Merchant and Retail Insights and get a free demo from a sales representative.

About Envestnet | Yodlee Merchant, Retail, Shopper, and Spend Insights

Envestnet | Yodlee Merchant, Retail, Shopper, and Spend Insights utilize de-identified transaction data from a diverse and dynamic set of data from millions of accounts to identify patterns and context to inform spending and income trends. The trends reflect analysis and insights from the Envestnet | Yodlee data analysis team. By combining data with intelligence – connecting vast amounts of actual de-identified shopping data with state-of-the-art analytics and machine learning – Envestnet | Yodlee provides visibility into a large set of shopping daily purchase behavior including, but not limited to, transactions, customer lifetime values, and merchant/retailer shares.