The 2024 holiday shopping season closed on a high note, as December retail spending surged past expectations, continuing the strong pace set by Black Friday and Cyber Monday. US consumers, buoyed by inflation cooling below 3% and resilient in the face of economic uncertainty, drove spending to new highs. E-commerce, in particular, outpaced projections, highlighting the ongoing shift toward online shopping.

Despite concerns over tariffs and broader economic conditions, Yodlee® data revealed that robust November trends extended seamlessly into December. This season’s spending surpassed 2023 levels by over 8% year-over-year (YoY), with online sales leading the charge.

Transaction data from millions of accounts provides a detailed view of these shifts across key retail categories, including big box, e-commerce, home improvement, department stores, specialty retail, discount chains, auto, footwear, and apparel. Analyzing de-identified credit and debit card transactions from 300 retailer brands spanning 66 public companies, Yodlee's insights underscore evolving consumer behavior during the holidays. For a list of all tickers analyzed, please reach out to our team.

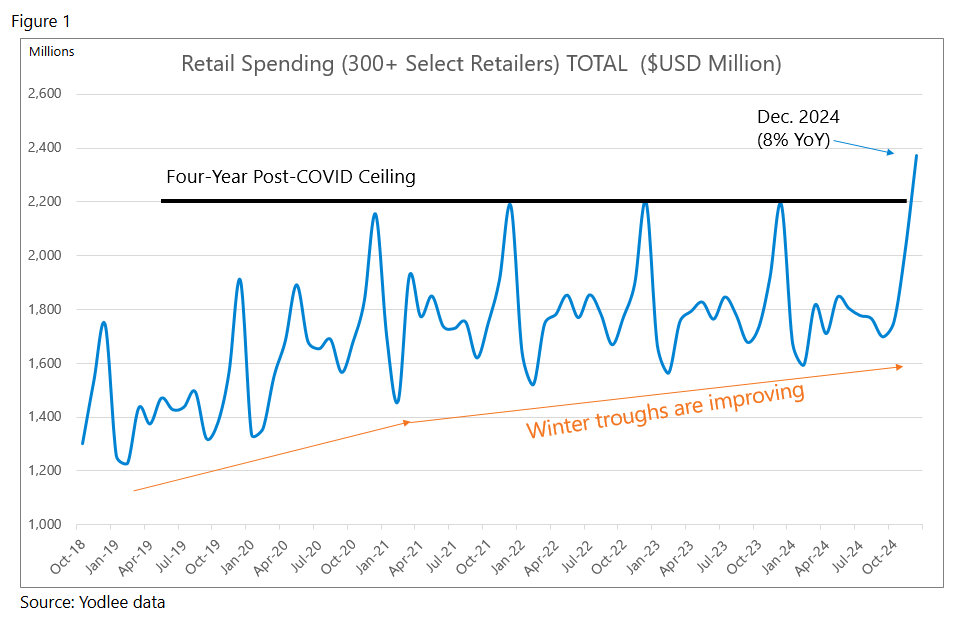

Breaking through a four-year ceiling in holiday spending

Even as some early reports point to a positive trend for holiday spending in the US, it exceeded expectations in 2024, with a remarkable 8% YoY increase in overall retail spending for our analyzed group of brands. This growth represents a significant milestone, breaking through the spending ceiling established during the post-COVID recovery period (see Figure 1).

Notably, while spending peaks remained relatively consistent in the years leading up to 2024, the seasonal low points—or winter troughs—have shown a steady upward trend year over year. This pattern suggests increased transaction volumes from consumers rather than price-driven growth (we’ll explore this in detail later). As we move into January and February, this momentum is expected to continue driving retail activity.

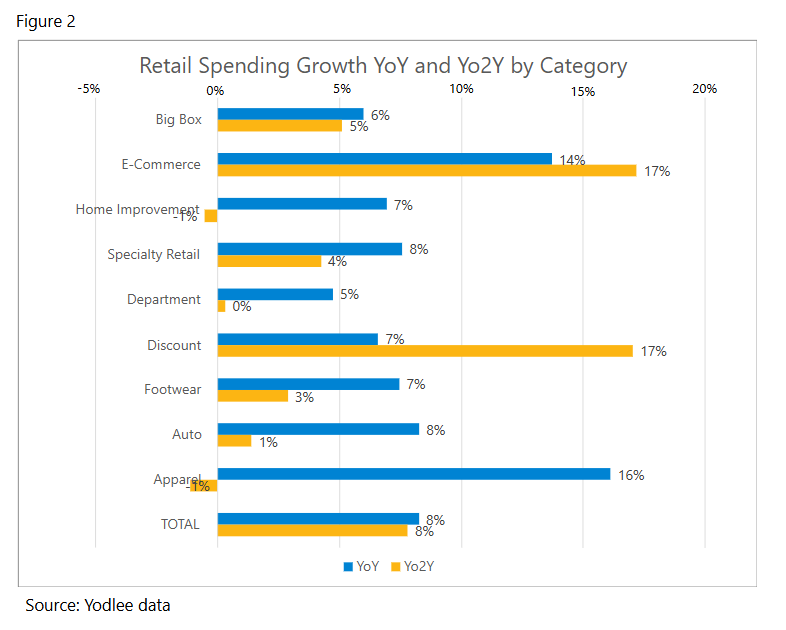

E-commerce and apparel lead holiday spending growth

Year-over-year (YoY) and year-over-two-year (Yo2Y) growth across retail categories reveal strong holiday season gains in 2024, with spending trends varying by sector (see Figure 2).

E-commerce emerged as a standout, posting a 14% YoY increase and solidifying its role as a dominant driver of holiday spending. Apparel brands also delivered impressive performance, achieving a 16% YoY gain. It’s worth noting that these results reflect pure-play e-commerce, without isolating the online components of traditional retailers.

While most categories saw positive growth, big box and home improvement brands lagged slightly behind, with YoY increases of 6% and 7%, respectively. This broad-based growth underscores shifting consumer preferences and the continued evolution of the retail landscape.

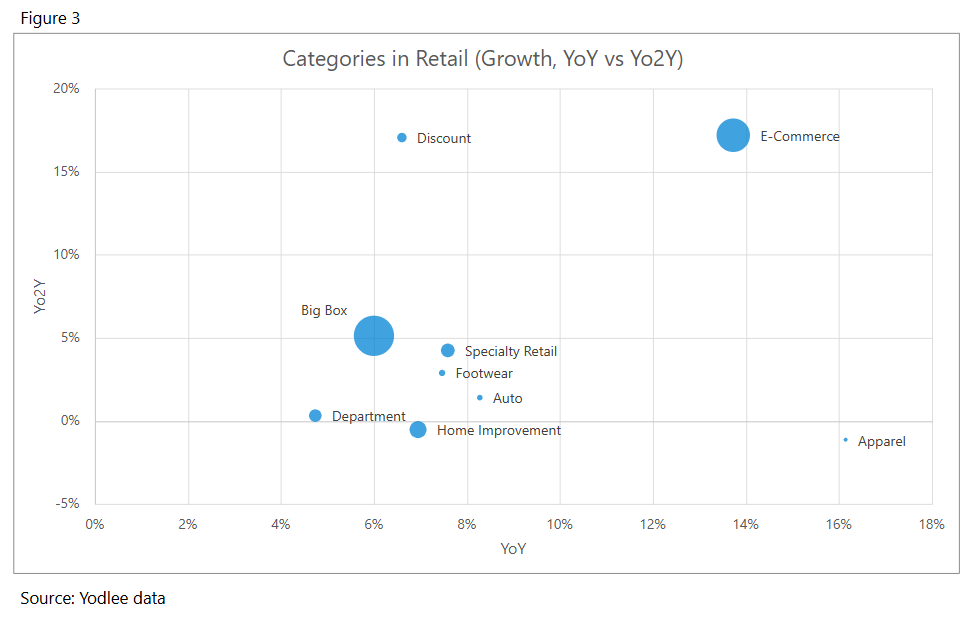

E-commerce drives growth despite strong performance from apparel

Although apparel brands performed strongly on average, the relative size of spending across categories highlights e-commerce as the primary driver of growth this holiday season. December spending patterns further emphasize this trend, with total spending represented proportionally by the size of each category’s bubble (see Figure 3).

E-commerce's dominance reflects its ability to capture a larger share of holiday spending compared to other categories, solidifying its growing influence in the retail landscape.

E-commerce outpaces other categories with broad-based growth

E-commerce brands not only outperformed but did so more consistently across the sector. Five out of the seven pure-play e-commerce companies analyzed posted strong YoY and Yo2Y gains, reflecting broad-based momentum in online shopping (see Figure 4).

In contrast, while apparel showed a higher overall YoY growth rate, this performance was driven by two standout companies with exceptional gains. Meanwhile, three out of six apparel brands saw flat or declining YoY spending.

These trends indicate a growing consumer preference for online shopping, but they also highlight opportunities for traditional retailers to enhance in-store experiences and attract holiday shoppers.

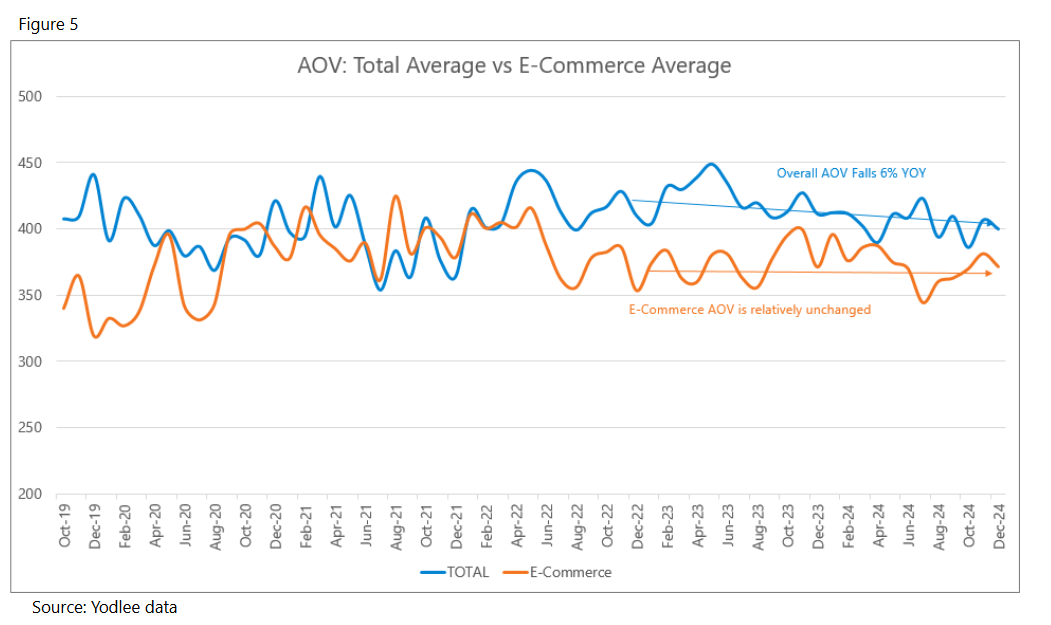

Increased spending driven by higher transaction volumes, not inflation

While it might be tempting to attribute the rise in holiday spending to higher prices, the data suggests otherwise. Average Order Values (AOV) across retailers have actually decreased by 6% since 2023, indicating that inflation was not a key factor behind the spending growth (see Figure 5). Instead, this trend likely reflects widespread discounting and deal-hunting behavior among shoppers.

Interestingly, while overall AOVs declined, online AOVs remained flat, signaling that e-commerce brands maintained stronger pricing power compared to their brick-and-mortar counterparts during the holiday shopping season. This data underscores the impact of shifting consumer preferences and strategic pricing on overall spending trends.

A record-breaking season powered by consumer resilience

The 2024 holiday shopping season highlighted the resilience and adaptability of US consumers, with record-breaking spending driven by increased transaction volumes, a shift toward online shopping, and strategic discounting. Yodlee's de-identified transaction data provided a comprehensive view of these trends, offering actionable insights into evolving consumer behaviors across retail categories. For those seeking to understand these shifts and anticipate future trends, Yodlee's data-driven insights continue to provide a powerful tool for navigating the dynamic retail landscape.

Want to see how transaction data can inform your investment process?

Learn more about Yodlee Merchant and Retail Insights and get a free demo from a sales representative.

About Yodlee Merchant, Retail, Shopper, and Spend Insights

Yodlee Merchant, Retail, Shopper, and Spend Insights utilize de-identified transaction data from a diverse and dynamic set of data from millions of accounts to identify patterns and context to inform spending and income trends. The trends reflect analysis and insights from the Yodlee data analysis team. By combining data with intelligence – connecting vast amounts of actual de-identified shopping data with state-of-the-art analytics and machine learning – Yodlee provides visibility into a large set of shopping daily purchase behavior including, but not limited to, transactions, customer lifetime values, and merchant/retailer shares.