By Maggie Fitzgerald

Originally published by CNBC

The GameStop bubble has come and gone but the rookie investors who speak emoji and Reddit may be here to stay with big implications for brokerage firms, as well as traditional investors who must pay closer attention to where this fast-moving, smartphone app-wielding crowd is moving next.

“We believe some of the new retail activity is here to stay,” wrote an analytics team at Bank of America in a report to clients.

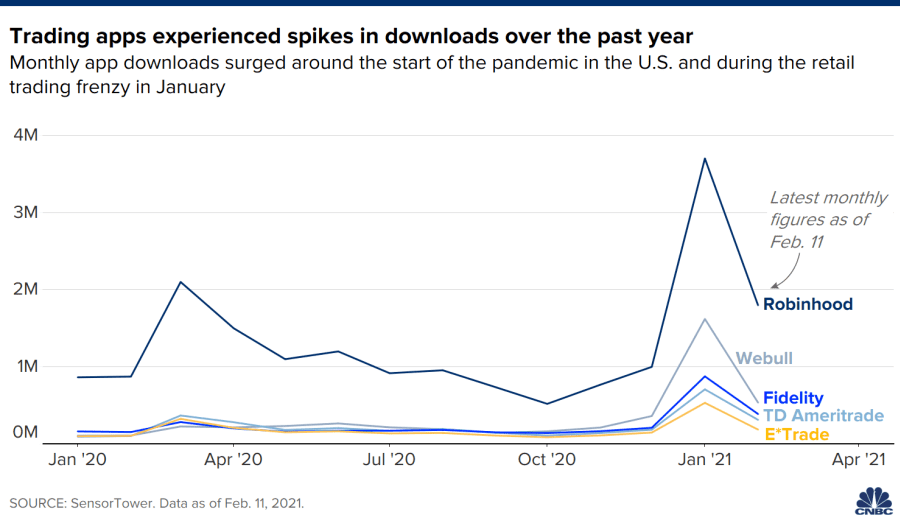

Bank of America’s team found that the unprecedented surge in brokerage app downloads during the GameStop mania is continuing at a rapid pace this month even with the GameStop trade itself now forgotten. Credit Suisse data shows retail trading as a share of overall market activity has accelerated in recent months and has now doubled compared to the start of last year.

Plus, with the potential for a new round of stimulus checks this month, another rush of cash from these new investors could be ahead.

Retail trading has been accelerating since the industrywide decision to drop commissions in the fall of 2019. Since then, the pandemic-fueled market volatility brought new investors into the world of stocks, sometimes for the first time. Work-from-home, stimulus checks and higher personal savings levels, as well as social media platforms like Reddit, have only accelerated the boom in retail trading.

There were 3.7 million downloads of Robinhood in January, according to app market intelligence firm SensorTower, even with the millennial-favored stock trading app’s unpopular decision to put trading restrictions on a handful of stocks during GameStop’s climb. After the GameStop drama in February, downloads are still tracking strongly with 1.8 million month-to-date.

Traditional brokerages like Charles Schwab and E-Trade also saw an influx of new clients, as well as new entrants like Webull. The download levels well surpassed the retail participation seen during the Covid-19 pandemic.

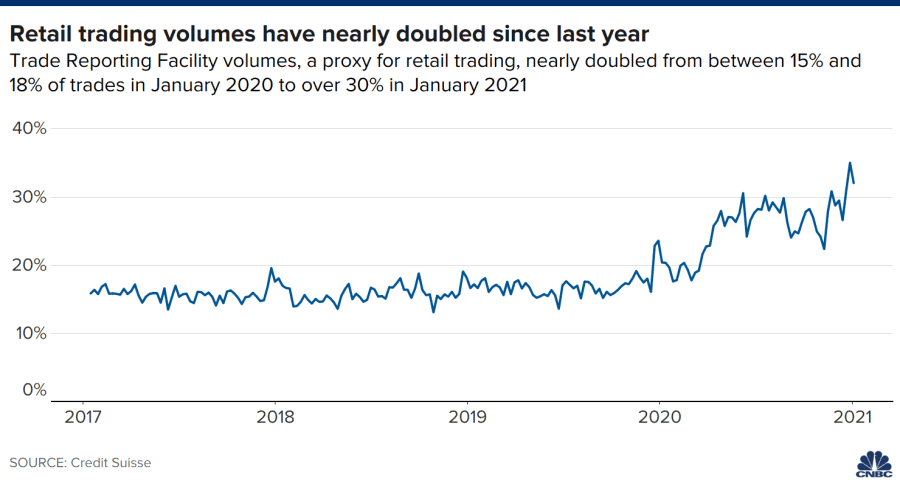

Retail trading has doubled since last year

Since the start of 2020, retail trading as a share of overall activity has nearly doubled from between 15% and 18% to over 30%, according to Credit Suisse. The chart shows a spike in activity in recent months.

The Wall Street firm estimates the total retail and wholesaler share of U.S. trading volume since 2017, using TRF, or trade reporting facility volumes, as a proxy for retail investing. It includes retail trades that are routed to market makers, as well as dark pools — which are private forums for trading. The vast majority of retail trades (90%) are reported to the facility.

Trading in general has doubled since last year. About 15 billion shares are traded every day, up from 7 billion last year, according to Piper Sandler.

“Double with retail being a greater percentage of that double in the marketplace,” Piper Sandler analyst Richard Repetto told CNBC earlier this week.

Retail investors have been specifically interested in options trading, a more sophisticated way to trade equities. At the largest e-brokers, 32.7 million contracts traded on all the equity option exchanges in December, according to Piper Sandler. In January, a record 39.8 million contracts a day traded.

Reddit crowd

A new, younger, more social-media-savvy cohort has entered the fray from the GameStop mania, a phenomenon that affects brokerage companies and traditional investors.

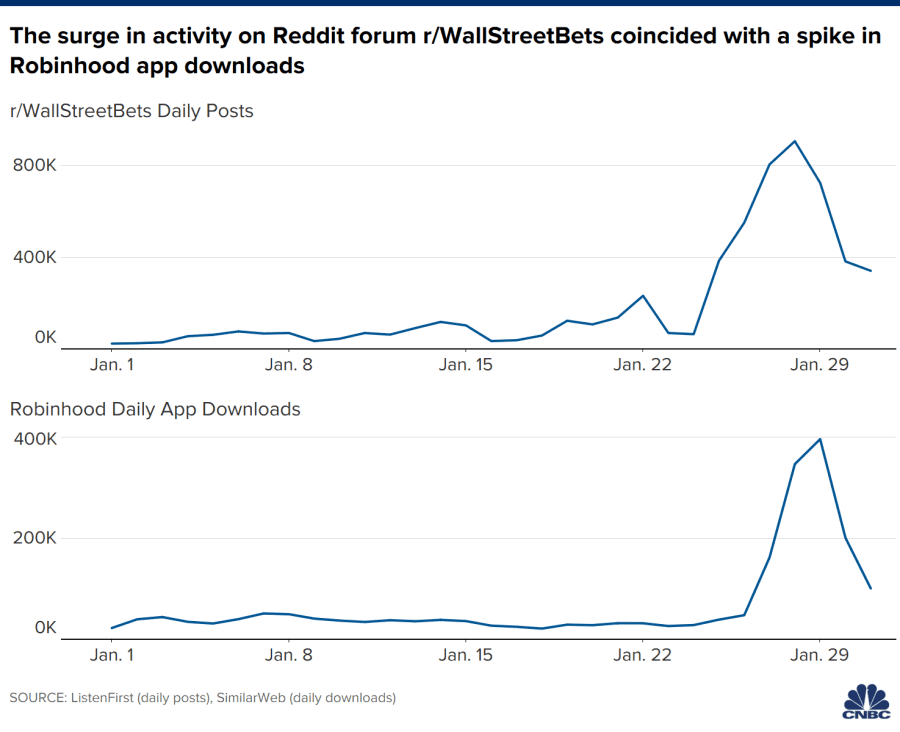

Posts on Reddit’s WallStreetBets page grew last month, so did accounts on Robinhood, according to social media analytics platforms ListenFirst and SimilarWeb. As conversations on WallStreetBets spiked above 800,000 each day, daily downloads of Robinhood topped 400,000 per day.

These accounts, and those on E-Trade and TD Ameritrade, were primarily investors between the ages of 18 and 34, according to Bank of America.

“This is important because it’s not just retail investors that may increasingly be a force in markets, its young retail investors,” stated the bank’s note.

While social media usage and retail trading have calmed this week, both are still elevated which “may suggest some of this higher interest could persist as investors look for the next short squeeze and as new investors have been brought into the fray,” stated the Bank of America report.

Stimulus checks on the way

House Speaker Nancy Pelosi expects Democrats will pass their next coronavirus relief package before the end of February. While direct payment allotments are still being debated, another round of stimulus checks could mean more liquidity for at-home traders.

“Based on prior activity around stimulus checks, we would expect another uptick in retail participation with another stimulus payment ahead,” Bank of America said.

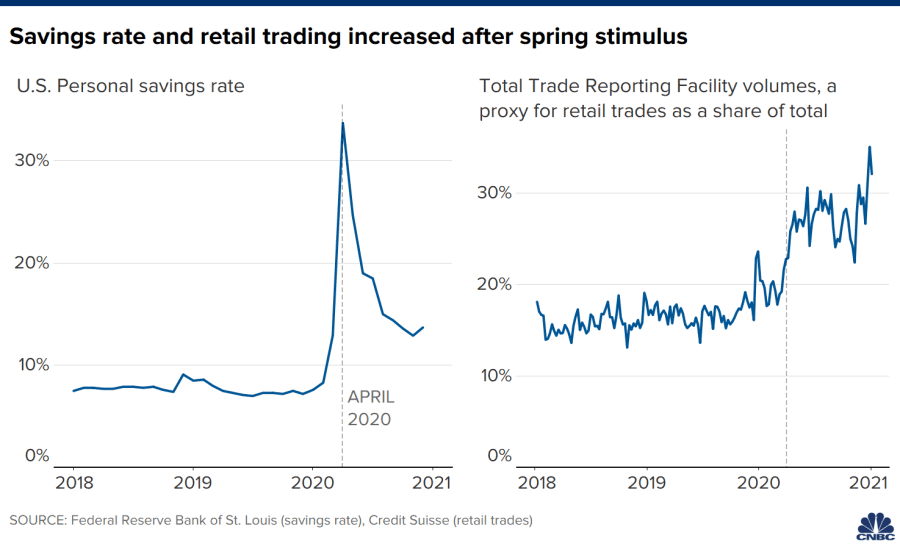

Last April, when the U.S. government passed the largest piece of stimulus legislation in our nation’s history to allow people to keep paying their bills during the forced economic shutdowns, some consumers put that money in the stock market.

Securities trading was among the most common uses for the government stimulus checks in nearly every income bracket, according to software and data aggregation company Envestnet Yodlee.

Most analysts attribute the flood of new investors to the attractiveness of the market comeback, the absence of sports, work-from-home trends and stimulus money. The personal savings rate rocketed to an all-time high in April 2020, demonstrating a phenomenon of “forced savings” that helped drive retail trading higher.

“We expect another uptick in retail activity with another round of stimulus, though the level will likely depend on the type of stimulus (broad based or targeted), the market backdrop at the time, as well as any potential regulatory changes discussed over the coming weeks,” said Bank of America.

Pay attention or get burned?

As the retail trading footprint grows, it could be beneficial to know the kinds of stocks individual investors like to buy and sell.

For example, this past week it was pot stocks. Cannabis companies surged in the beginning of the week amid an uptick in Reddit conversations about the weed companies. The group came back down to Earth on Thursday, but there was nothing small about the swings in stock prices.

While Apple and Tesla are typically the biggest stocks bought by retail investors, according to Apex Clearing, Credit Suisse points out that retail’s focus has been on small and mid-cap stocks over the past 12 months.

This adds up as retail traders were some of the first to buy into the little, beaten-down stocks during the coronavirus market rout.

Retail investors gave Wall Street pros a run for their money during the market comeback last March, with the amateurs’ top picks outperforming those of hedge funds, Goldman Sachs noted.

Small investors also hopped into the heavily-shorted small cap stocks like GameStop and AMC Entertainment. This attention might even make institutions think twice about the stocks they are shorting, avoiding names with a very high percentage of the float tied up in short interest.

Retail investors, specifically the younger kind, also have a preference toward cryptocurrencies, Bank of America told clients.

“With the surge of retail trading since late January 2021, we note that social media conversations on stocks has slowed over the past few days while interest on crypto keeps accelerating,” Bank of America told clients.