Fitness has long been an area of focus for investors, given the increase in consumer interest in wellness and the category differentiation across gyms. The industry saw a radical change in the aftermath of the COVID-19 pandemic. According to the Wall Street Journal, between 2019 and 2022, the number of domestic gyms shrunk from roughly 41,000 to 31,000, a 24% reduction. With that change in supply/demand balance, opportunities have arisen for investors.

Fitness category breakdown: Value, classes, luxury, and at-home fitness

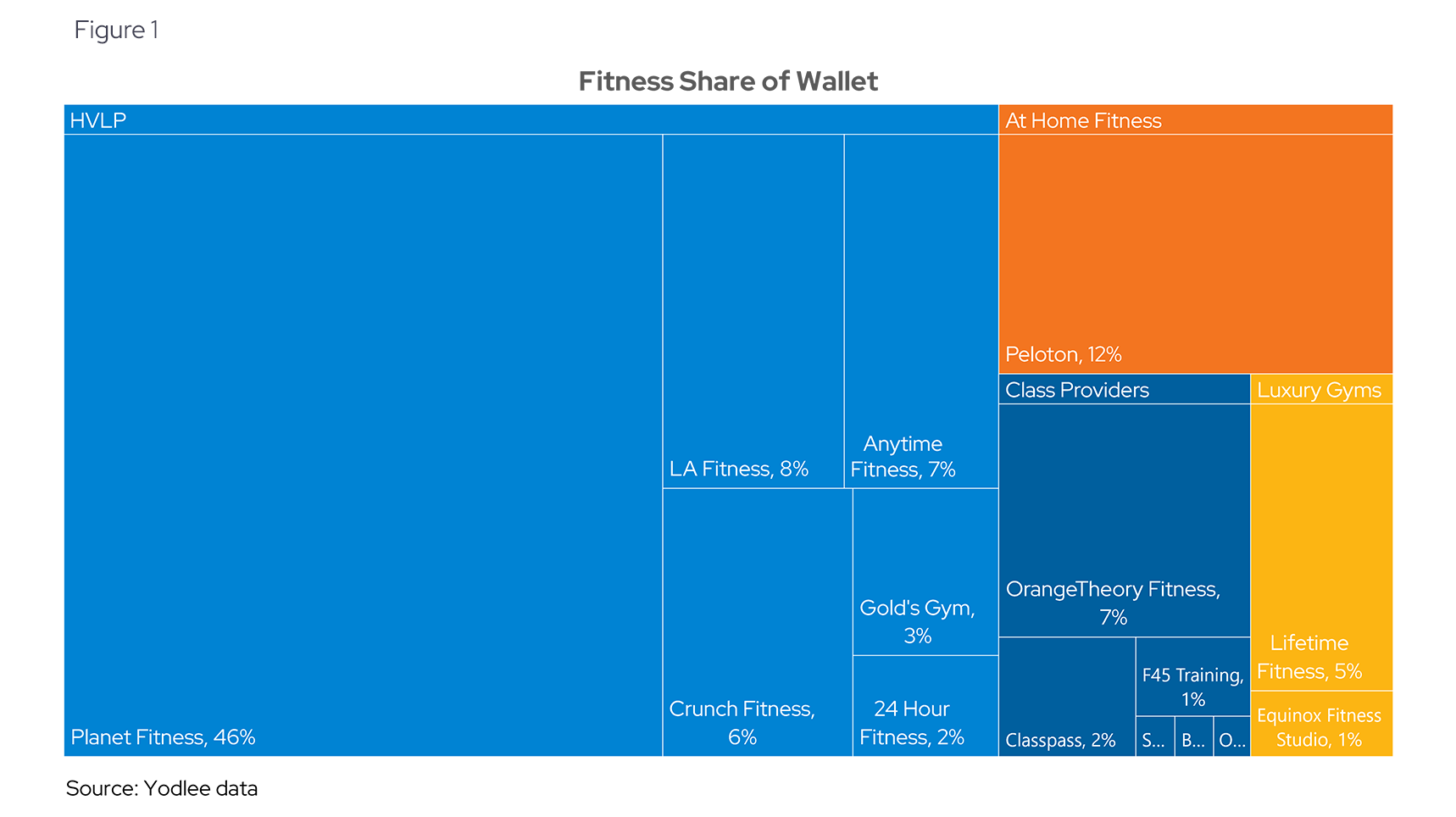

There are a few different categories that are important to differentiate. At the value end of gyms are the high-value, low-price options. These include Planet Fitness (PLNT US), 24 Hour Fitness (which filed for bankruptcy protection in 2020), Gold’s Gym (ditto), Crunch Gym, Anytime Fitness, and LA Fitness. These gyms are characterized by low monthly price points. Many of their customers are first-time gym members. The name of the game with the high-value, low price models tends to be high retention rates given their low monthly cost. Some such as Planet Fitness are franchise models, which are less capital intensive for the parent given the franchisor foots the bill for gym build-out and equipment.

An area of growth has been class providers, taking various shapes and forms. These include SoulCycle (owned by Equinox Holdings), Barry’s Bootcamp, F45 (FXLV US), O2 Fitness, and OrangeTheory. ClassPass aggregates many of these (and a long tail of independent gyms) for consumers through a monthly credit system. This flexibility and variety make ClassPass an attractive option for consumers looking to explore different fitness classes without committing to a single gym or studio.

At the high-end are luxury gyms such as Life-Time Fitness (LTH US) and Equinox. Both have pursued price-taking strategies (more on that later), layering in ancillary services ranging from spas, personal training, biomedics, leisure sports (such as swimming and pickleball), and hospitality (Equinox has expanded its services into hotels). These gyms have focused on targeting affluent customers who view them as the favored path to stay fit in the era of remote work. Their business focus has been expanding prices across their cohort of services.

The fourth category is at-home fitness led by Peloton and a handful of minor players such as Nautilus and Mirror (acquired by Lululemon). This trend skyrocketed during the early part of the lockdown period prior to broad vaccine dissemination and has subsequently come back down to normal. Without the variety and social aspects associated with gyms, it has been tough for these firms to maintain their pandemic-peak growth as people tend to prefer a variety of exercise options. Nevertheless, they are still a meaningful option for consumers.

Across the Yodlee aggregate fixed cohort of de-identified debit and credit card transaction data, we captured nearly $35 million of monthly spend across these four gym categories. Figure 1 shows a distribution of our spend capture.

Shifts in post-COVID spending habits in the fitness industry

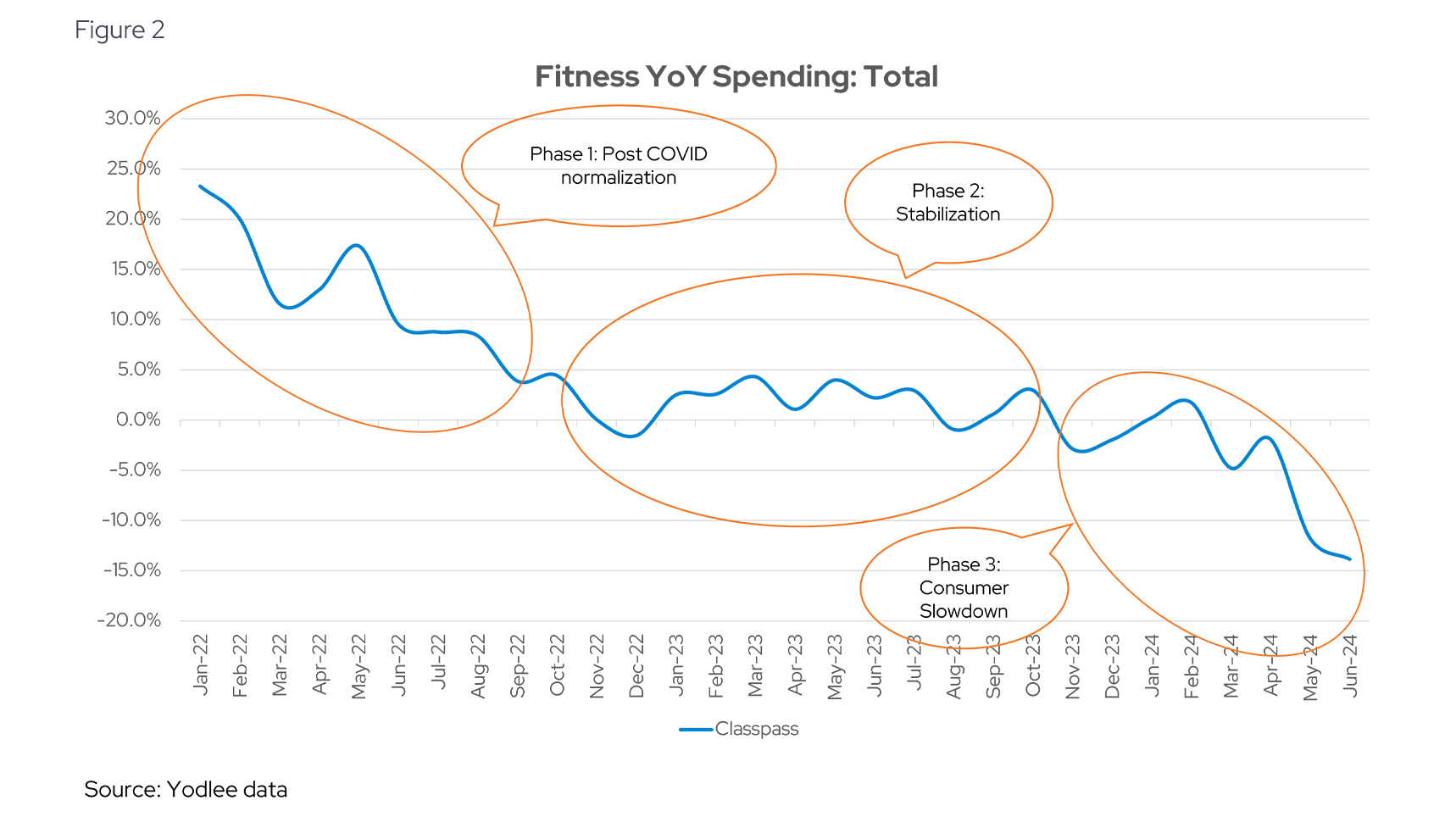

There have been three distinct periods in spending habits in the post-COVID period (see Figure 2). The first period saw rapid growth in 2022 as the world reopened and many people, eager to return to or develop their fitness routines, flocked back to gyms. This growth was understandably unsustainable and hit a stabilization period in 2023, during which growth rates began to level off across the aggregate cohort. However, in 2024, we have noticed deceleration in gym spend across our data, which has been corroborated by several companies that provide public disclosures. This trend may indicate consumers pulling back for various reasons. For instance, Planet Fitness' interim CEO noted in their 1Q24 earnings call that many brands in the fitness industry experienced a similarly slow start to the year. This may be characterized as the consumer pulling back for a myriad of reasons.

Perhaps more concerning, that deceleration increased into the second quarter, where warmer weather provides a reason to put that gym memberships on hold. This presents an interesting dichotomy for the various brands, especially as investors look to understand where higher-frequency data is moving against consensus.

Pricing dynamics across gym cohorts

Gyms face significant capital expense associated with facility build-outs and periodic equipment refreshes. With input costs rising substantially, this has created financial pressure on various high-value, low-price options. This pressure apparently culminated between Planet Fitness and its franchisees. As the largest player in the industry, the company made headlines by unexpectedly firing its CEO in February 2024, causing shares to drop 20%. In May, Planet Fitness announced its first price increase in over 25 years, just days leading into its annual franchisee convention. The price increase will be phased in during the summer, likely becoming a key point of focus for investors.

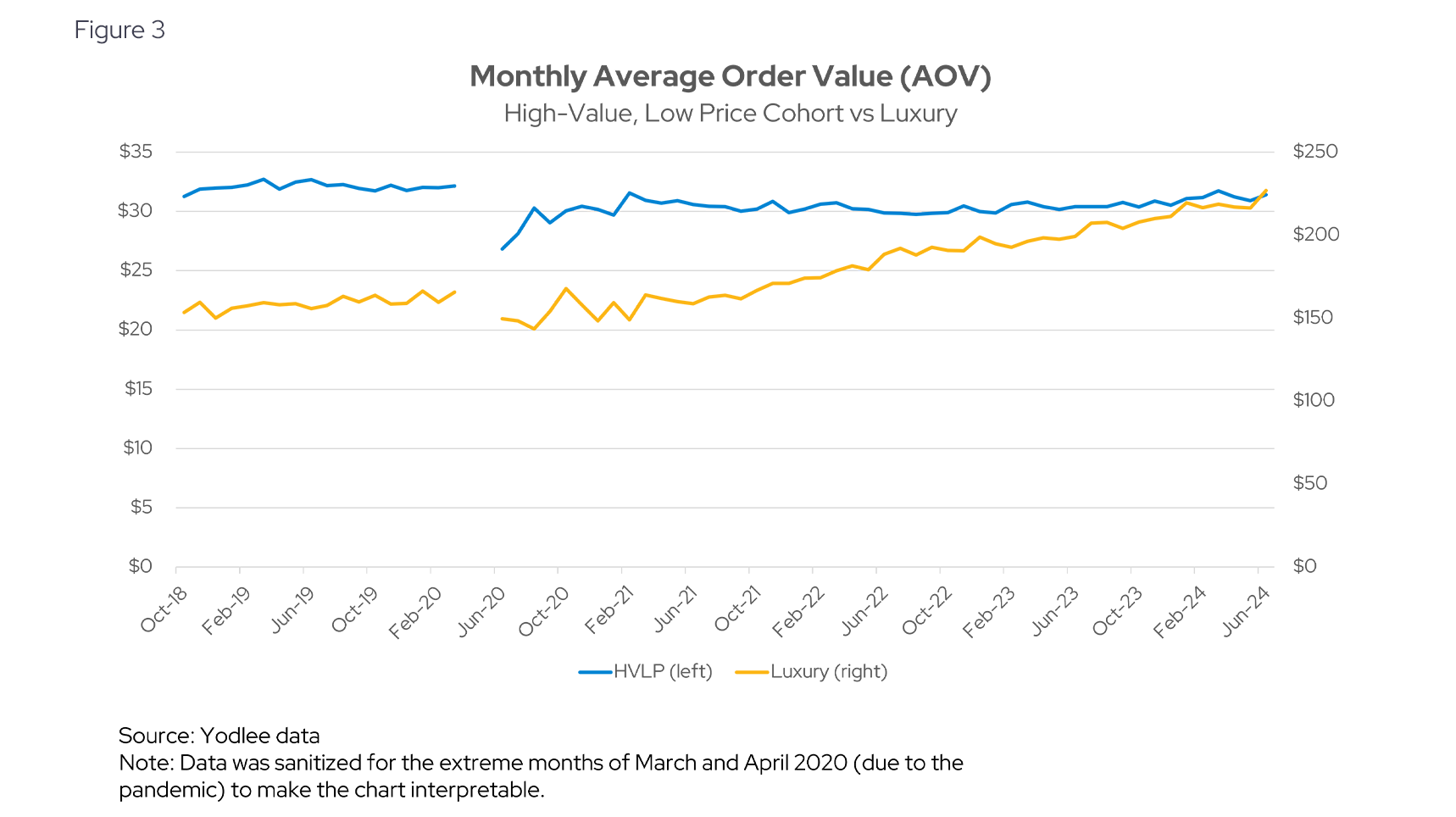

In contrast, luxury gyms have been consistently raising prices. This strategy appears to be effective, as monthly spending captured through Yodlee data has steadily climbed in the post-pandemic period (see Figure 3).

As shown in Figure 3, while our high-value, low price cohort has maintained a monthly spend by user in the low $30s for nearly six years despite rising equipment costs, the luxury gym cohort, including Lifetime (LTH US) and Equinox, has seen a significant increase. Monthly revenue per user in this segment has risen from $150 to approximately $225, marking a 50% increase.

2024 membership cancellations and retention rates at gyms

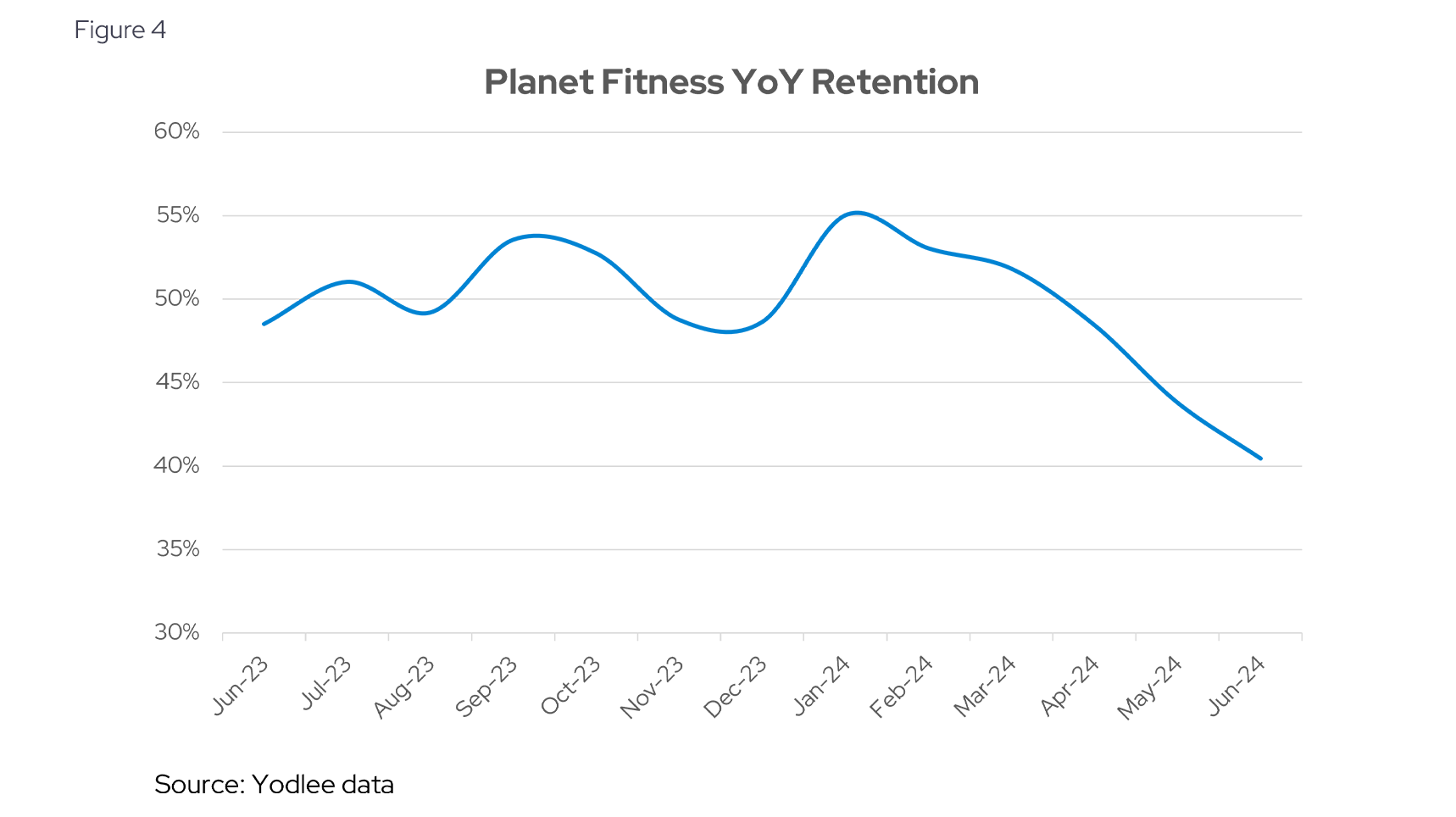

A gym charging users $10-15 per month must maintain robust retention rates to balance the costs associated with churn and keep utilization rates high. Although some costs are offset by one-time onboarding fees, analyzing user cohort retention rates is crucial to understanding consumer receptivity to specific concepts. Planet Fitness consistently ranks high in year-over-year retention across our Yodlee aggregate cohort. However, we have observed some softening in their retention rates as we move into 2024 (see Figure 4) which will be worth watching as price increases are implemented.

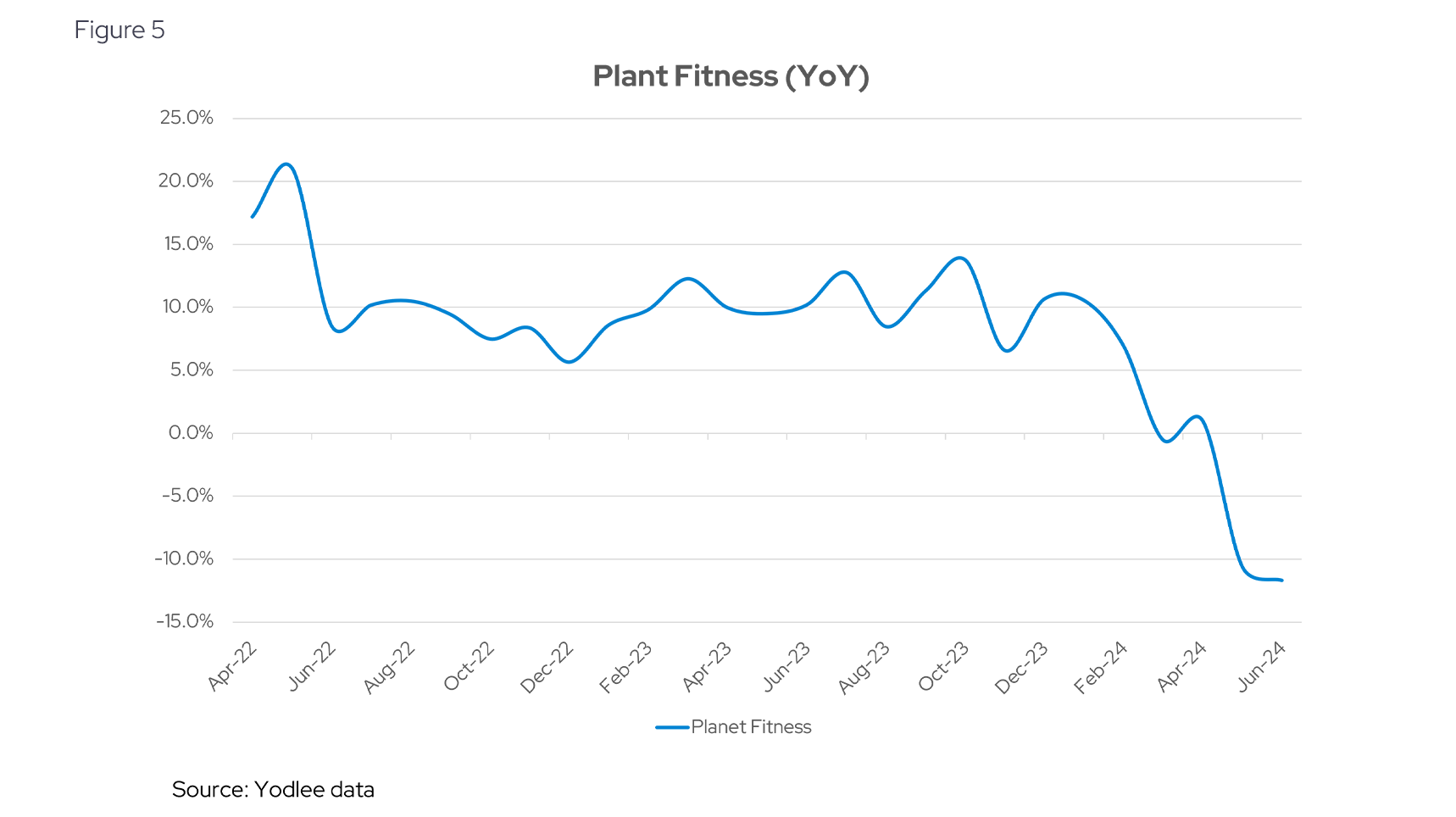

The associated deceleration in year-over-year growth has been concerning (see Figure 5). Planet Fitness' June performance will significantly influence their second quarter results, a closely watched report given the volatility around management changes, the implementation of a drastically new pricing strategy, and the overall trends in consumer spending habits in 2024. Our data composite indicates a softer June than consensus expectations, which will likely impact the quarterly results.

Migrating consumer habits paint a complex picture

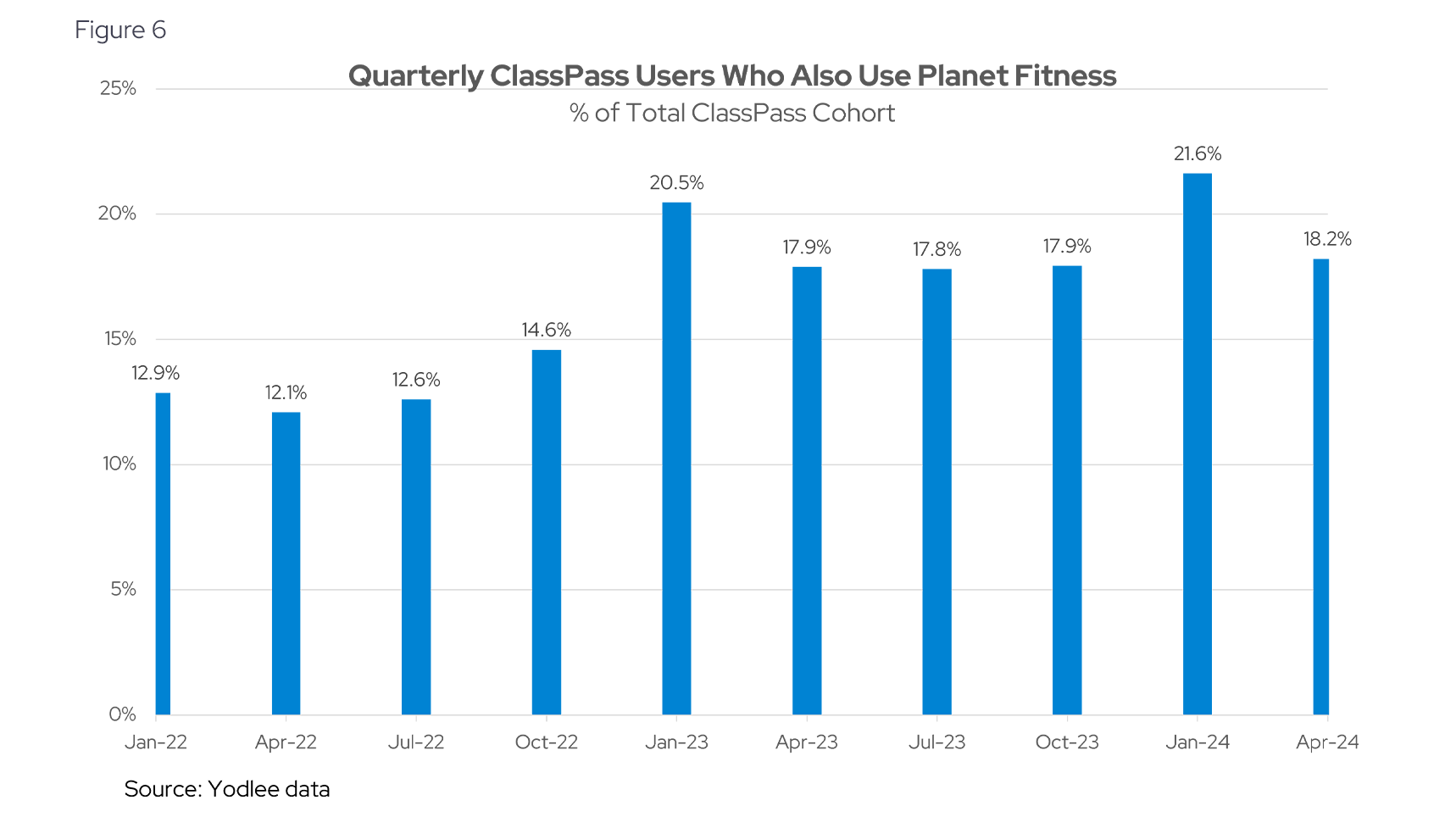

Evolving consumer habits paint a complex picture. One trend across gyms is the movement of users up, down, and across the ecosystem. For instance, ClassPass, as an aggregator, allows users to test several gym concepts without committing to a single one before potentially choosing a permanent home. Yodlee data reflects this behavior, capturing significant cross-sales between ClassPass and various vendors (see Figure 6). Unsurprisingly, the largest cross-sale partner with ClassPass has been Planet Fitness, followed by Peloton, as some users find a combination of infrequent class visits and at-home activities ideal.

Historically, the cross-membership rate between ClassPass and Planet Fitness has been in the low teens, but it increased significantly in 2023 to the high teens (see Figure 6).

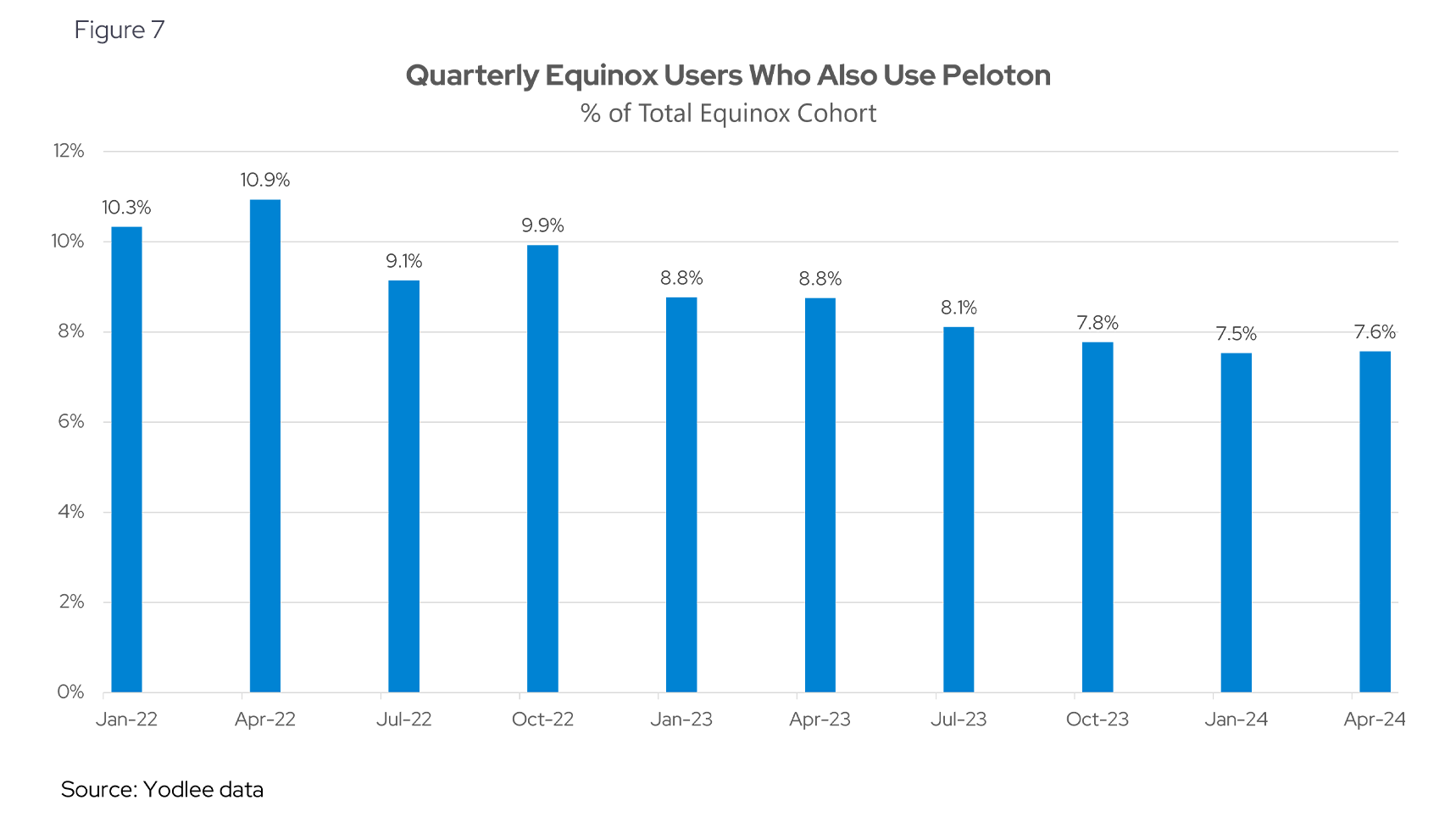

Figure 7 suggests a decelerating trend among users who frequent Equinox, a luxury gym, and also maintain a monthly Peloton membership. This could indicate that this cost-insensitive cohort is showing a meaningful reduction in dual usage, potentially signifying a saturation in consumer spending in this segment.

Implications for investors in the fitness sector

Ultimately, investors want to understand how strategic changes across gym cohorts, both public and private, will unfold. With inflationary cost pressures impacting the low-end and price increases prevalent at the high-end, the key question is whether these trends will sustain or shift. Yodlee data indicates a slowdown in the low-end, primarily driven by Planet Fitness, the largest player in this cohort, serving as a warning sign. Additionally, the reduction in cross-spend at the high-end may be an early indicator of a shifting trend among high-end consumers. Investors should closely monitor these developments to gauge future performance and opportunities in the fitness sector.

Want to see how transaction data can inform your investment process?

Learn more about Envestnet | Yodlee Merchant and Retail Insights and get a free demo from a sales representative.

About Envestnet Data & Analytics Income and Spending Trends

Envestnet Data & Analytics Income and Spending Trends utilize de-identified transaction data from a diverse and dynamic set of data from millions of accounts to identify patterns and context to inform spending and income trends. The trends reflect analysis and insights from the Envestnet | Yodlee data analysis team.