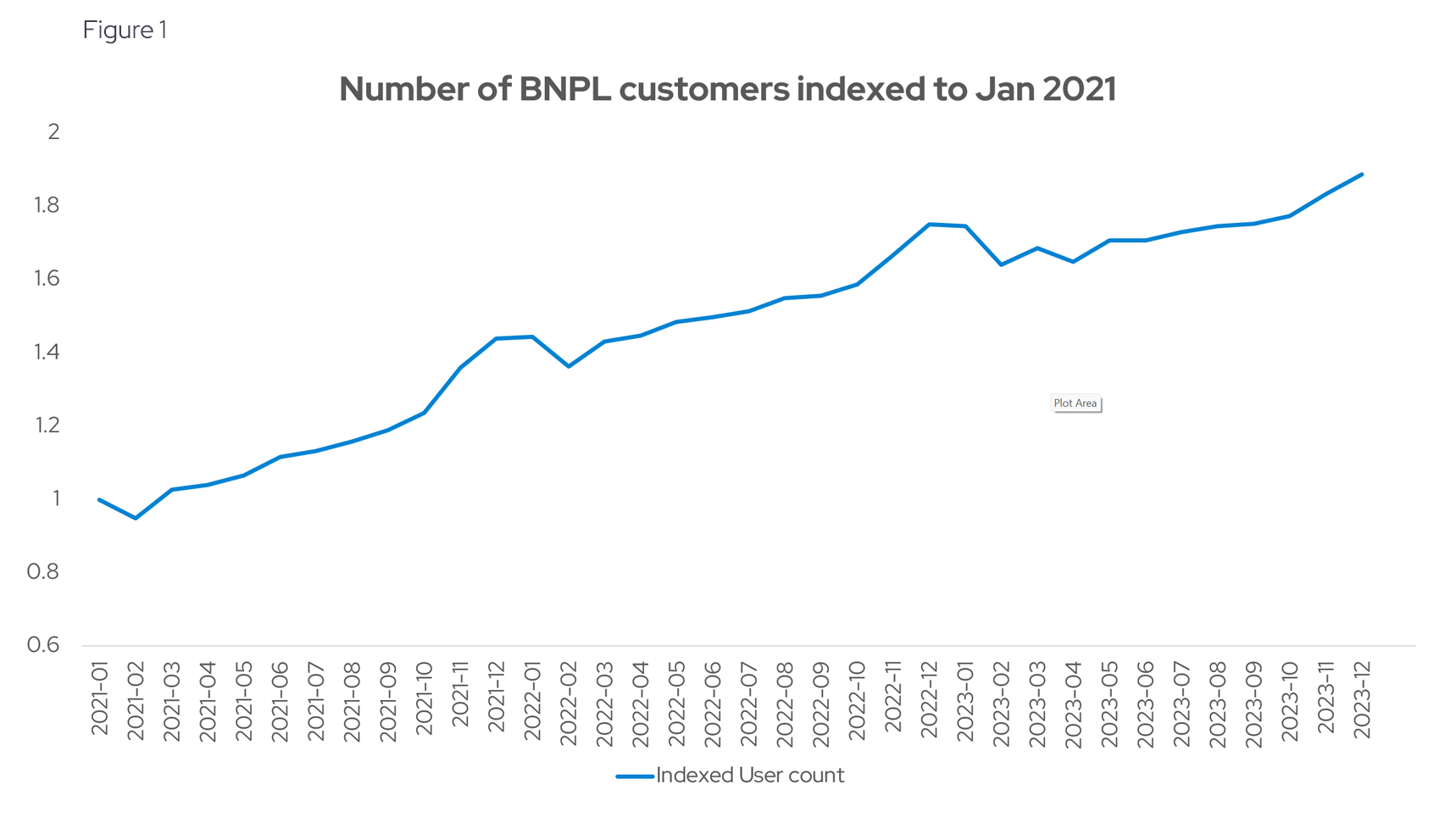

BNPL grew significantly from 2021 to 2023

Envestnet® | Yodlee®data showed significant growth in the Buy Now, Pay Later (BNPL) market since 2021 (see Figure 1). More recently, user growth has moderated.

This is in alignment with a BNPL survey from Experian that stated BNPL plans increased in popularity over the 2023 holiday season and some expect the plans to become even more interwoven into the commercial life of consumers, not only in December but also in the other 11 months of the year. Consumers cite managing spending, convenience, and avoiding interest as main reasons for using BNPL.

Want to get ahead of consumer spending trends?

Subscribe to our research data blog for ongoing updates or reach out for a personalized, up-to-date view of Yodlee consumer spending data.

About Envestnet | Yodlee Merchant, Retail, Shopper, and Spend Insights

Envestnet | Yodlee Merchant, Retail, Shopper, and Spend Insights utilize de-identified transaction data from a diverse and dynamic set of data from millions of accounts to identify patterns and context to inform spending and income trends. The trends reflect analysis and insights from the Envestnet | Yodlee data analysis team. By combining data with intelligence – connecting vast amounts of actual de-identified shopping data with state-of-the-art analytics and machine learning – Envestnet | Yodlee provides visibility into a large set of shopping daily purchase behavior including, but not limited to, transactions, customer lifetime values, and merchant/retailer shares.

To learn more about Envestnet | Yodlee Merchant and Retail Insights and get a free demo, please contact an Envestnet | Yodlee sales representative.