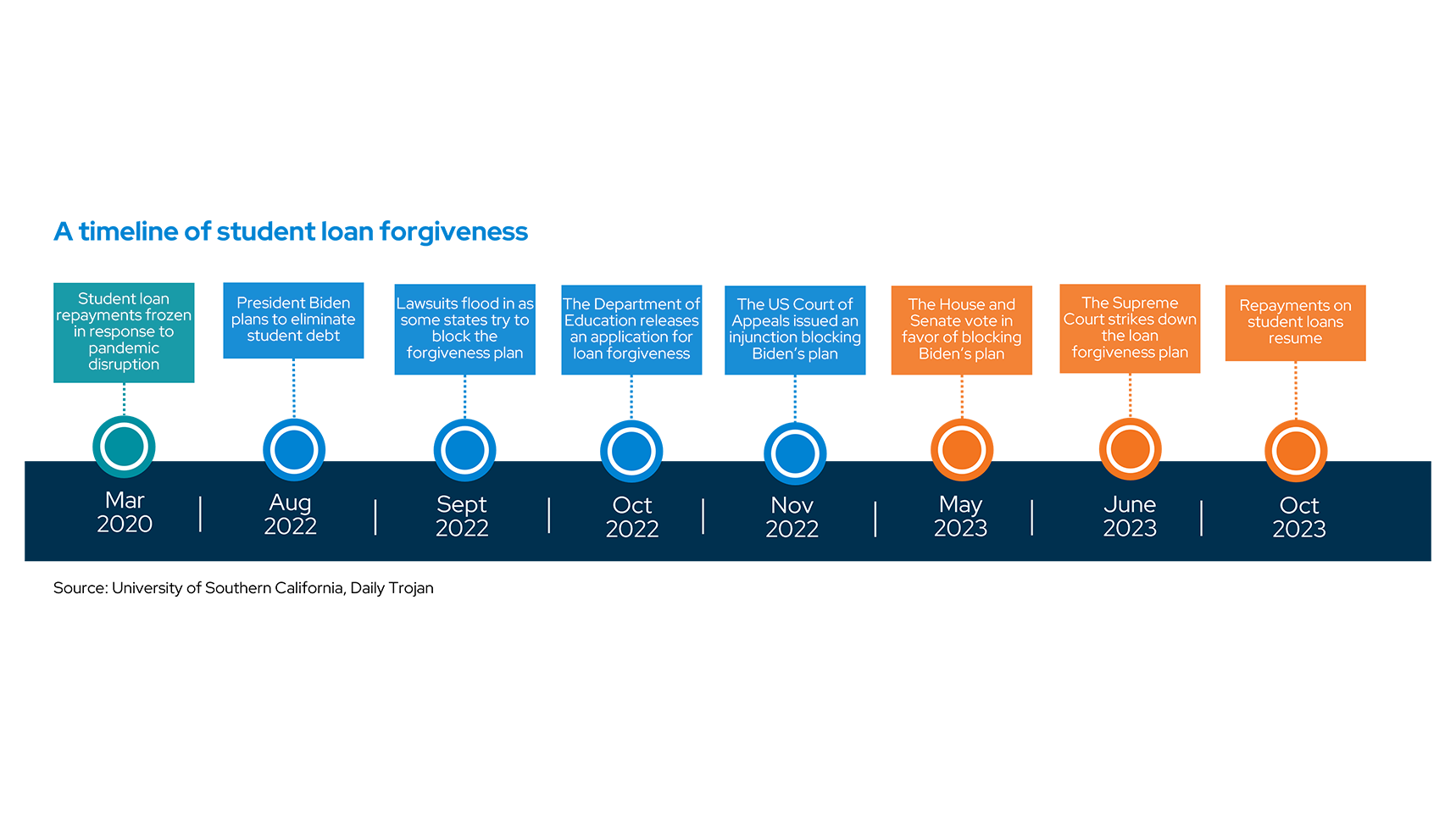

The COVID-19 pandemic presented unprecedented challenges across various sectors, including education finance. In response, the federal government initiated a series of student loan forbearance measures starting in March 2020 to ease the burden on borrowers during the crisis. These measures primarily targeted federal loan borrowers and were repeatedly extended, reflecting the ongoing economic impacts of the pandemic. The relief program was challenged by several states and interest groups for more than two years and was eventually discontinued after the Supreme Court ruled against it in June 2023. In this article, we show how Envestnet® | Yodlee® deidentified indirect transaction data shows the same trends direct sources can provide.

Data Analysis Framework

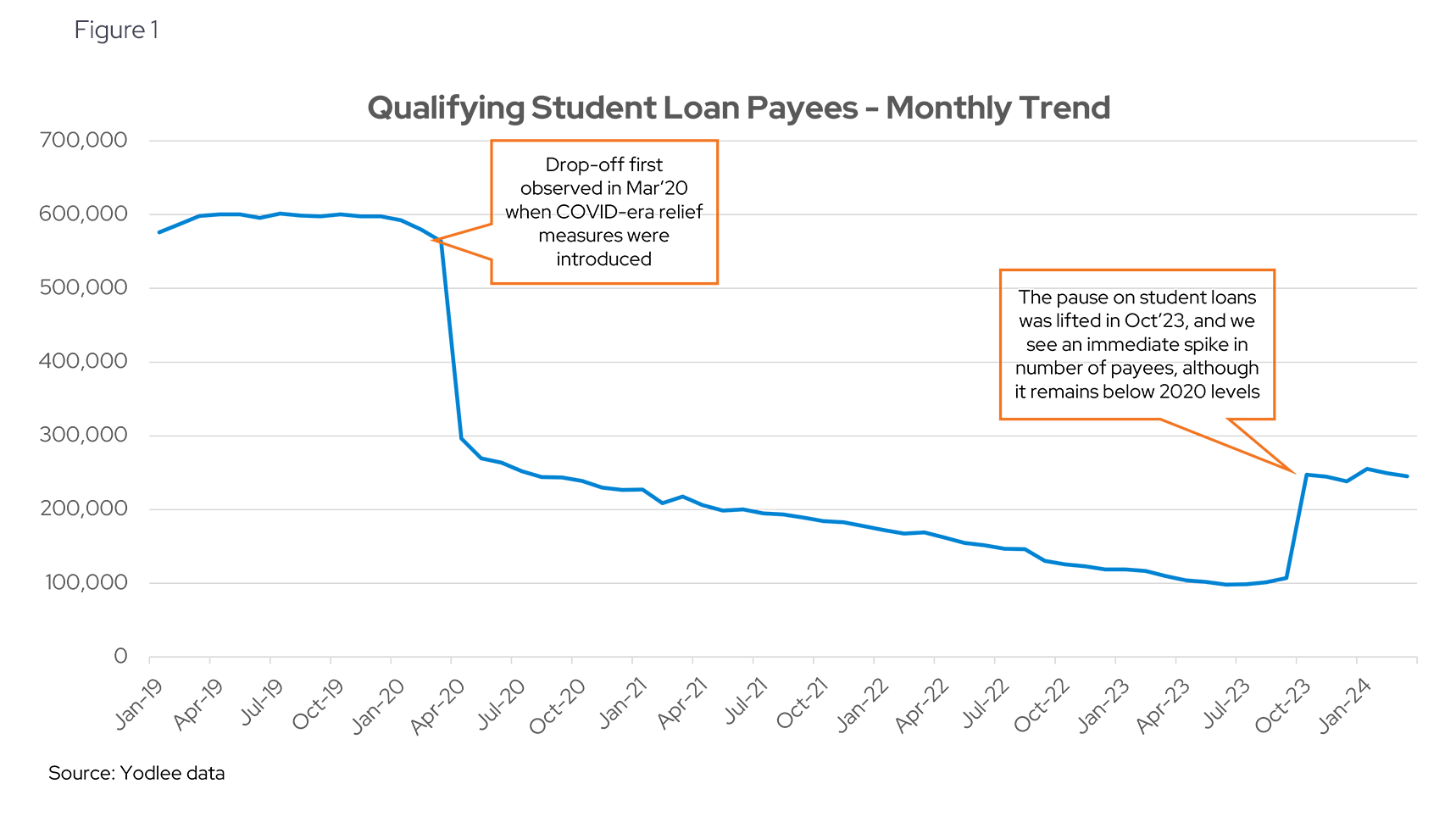

To analyze the impact of these relief measures, we used a custom cohort of federal student loan providers/servicers identifiable in our network transaction data. Our analysis focused on borrowers who consistently made payments before the pandemic, allowing for a clear before-and-after comparison.

Consistency with Official Timelines

Yodlee data shows a sharp decline in the number of borrowers making monthly payments starting from March 2020, aligning perfectly with the timeline when the relief measures were implemented. This trend continued until October 2023, when the relief measures concluded, underscoring the precise matching of our proprietary deidentified transaction data with trends from official sources on the timing of these initiatives.

Effect of 0% Interest Rate

Throughout the forbearance period, average monthly payments remained largely unchanged, reflecting the effect of the 0% interest rate on federal student loans. This crucial aspect demonstrates that the interest accrual was effectively paused, allowing borrowers to resume payments from where they had left off once the measures ended. Our findings echo the direct data sources that emphasized the implementation of interest waivers under the forbearance programs.

Implications for Data-Driven Decisions

The student loan forbearance programs served as a relief mechanism during the pandemic, successfully easing the financial burden on millions of borrowers. Our data analysis confirms that the implementation of these measures was timely and effectively paused interest accrual, supporting borrowers through a challenging period.

These insights are particularly valuable for professionals utilizing credit data to make informed decisions. Our analysis showcases the reliability of using transaction data to mirror and validate trends observed in direct data sources. This kind of data-driven insight is essential for policymakers, financial institutions, and educational entities as they plan for future crises or adjustments to student loan handling. It demonstrates the power of analytical approaches in validating the impact of national policies and provides a blueprint for future data analysis in similar contexts.

Want to leverage alternative lending data to create competitive offers, help minimize risk, and serve a wider range of consumers?

Learn more about Envestnet | Yodlee Credit Accelerator

About Envestnet | Yodlee Merchant, Retail, Shopper, and Spend Insights

Envestnet | Yodlee Merchant, Retail, Shopper, and Spend Insights utilize de-identified transaction data from a diverse and dynamic set of data from millions of accounts to identify patterns and context to inform spending and income trends. The trends reflect analysis and insights from the Envestnet | Yodlee data analysis team. By combining data with intelligence – connecting vast amounts of actual de-identified shopping data with state-of-the-art analytics and machine learning – Envestnet | Yodlee provides visibility into a large set of shopping daily purchase behavior including, but not limited to, transactions, customer lifetime values, and merchant/retailer shares.

To learn more about Envestnet | Yodlee Merchant and Retail Insights and get a free demo, please contact an Envestnet | Yodlee sales representative.