It’s clear that the US consumer has faced numerous challenges this year but has proven remarkably resilient despite the inflationary environment and uncertain economic outlook. This resilience was evident in the retail trends we covered during the summer and back-to-school season of this year. According to Yodlee’s analysis, this year’s Black Friday and Cyber Monday sales, along with promotions leading up to them, saw US consumers setting a new record in spending, surpassing last year’s numbers by an impressive 10% year-over-year (YoY).

Analyzing transaction data from millions of accounts, we uncover insights into the evolving across consumer retail. For this analysis, we examined transaction data for a range of brands across big box, e-commerce, home improvement, department, specialty retail, discount, auto, footwear, and apparel. Our findings reveal patterns in Black Friday discounts and Cyber Monday deals, spending breakdowns by category, market dynamics, historical transaction trends and more.

This article examines data for 300 retailer brands across 66 public companies in the US. The data is based on de-identified transactions that are sourced from credit and debit cards by Yodlee through partner financial institutions.

Consumer Optimism Drives Record-Setting Black Friday Spending

A screenshot of a computer With inflation stabilized and well below 3%, consumer confidence has rebounded to its highest levels since 2023. There have also been reports that consumers are loading up on staples ahead of potential tariffs on China and other nations. This “tariff fear” may be influencing increased retail activity. Against that backdrop, shoppers eagerly took advantage of deals and discounts offered up by retailers during Black Friday 2024.

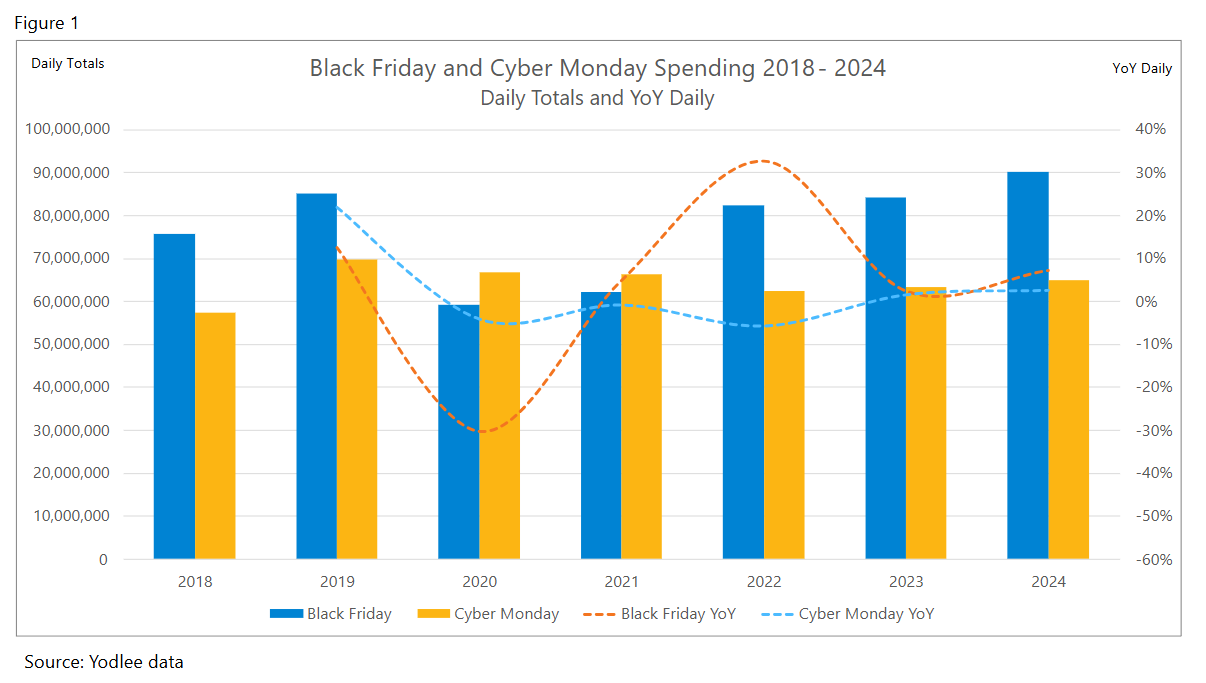

This year, Black Friday single day spending set a record for our group of retailers, rising 7% year over year. Cyber Monday also delivered strong results with 2.6% YoY growth (see Figure 1). However, these figures only tell part of the story. Black Friday sales are no longer confined to a single day, as many retailers often offer discounts leading up to Black Friday.

Early Deals Drive 10% YoY Growth in Black Friday Spending

The trend was even stronger when considering the growing tendency of consumers to shop ahead of Black Friday. Yodlee data indicates that consumer spending was strong not only on Black Friday itself, but also in the days leading up to it. Many retailers began offering discounts and promotions as early as one week before, and this year, shoppers responded enthusiastically to these early deals.

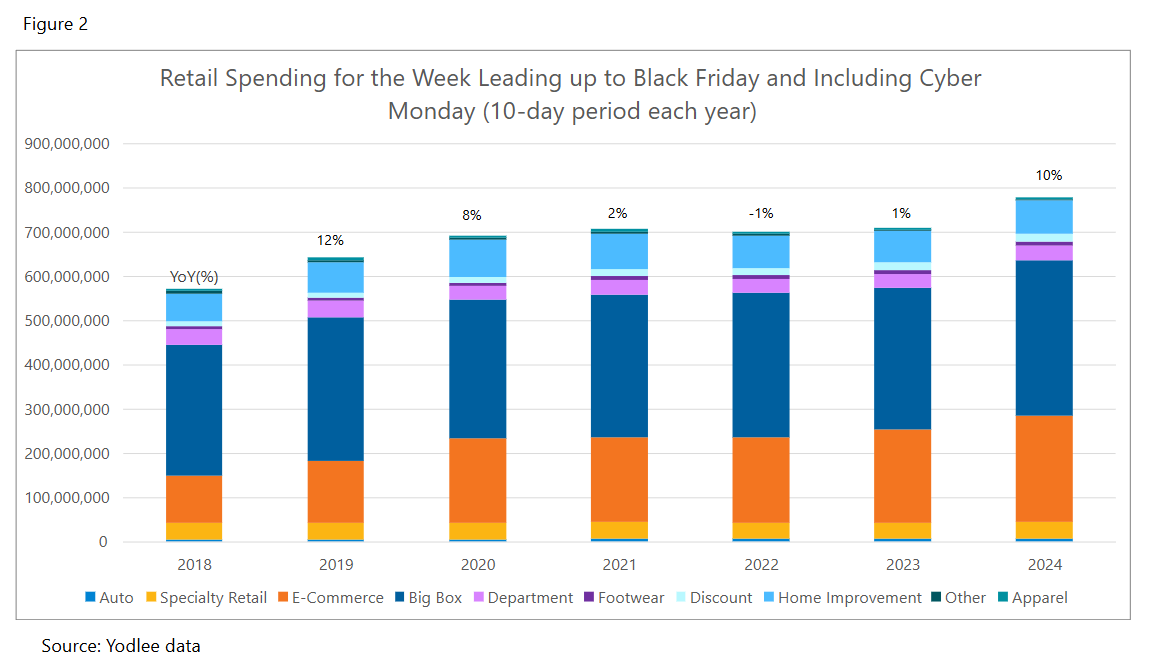

From the Saturday before Black Friday through Cyber Monday – a 10-day period of heavy discounting – overall spending increased by 10% YoY in 2024 (see Figure 2).

Major Spending Categories Show YoY Growth During Black Friday Week

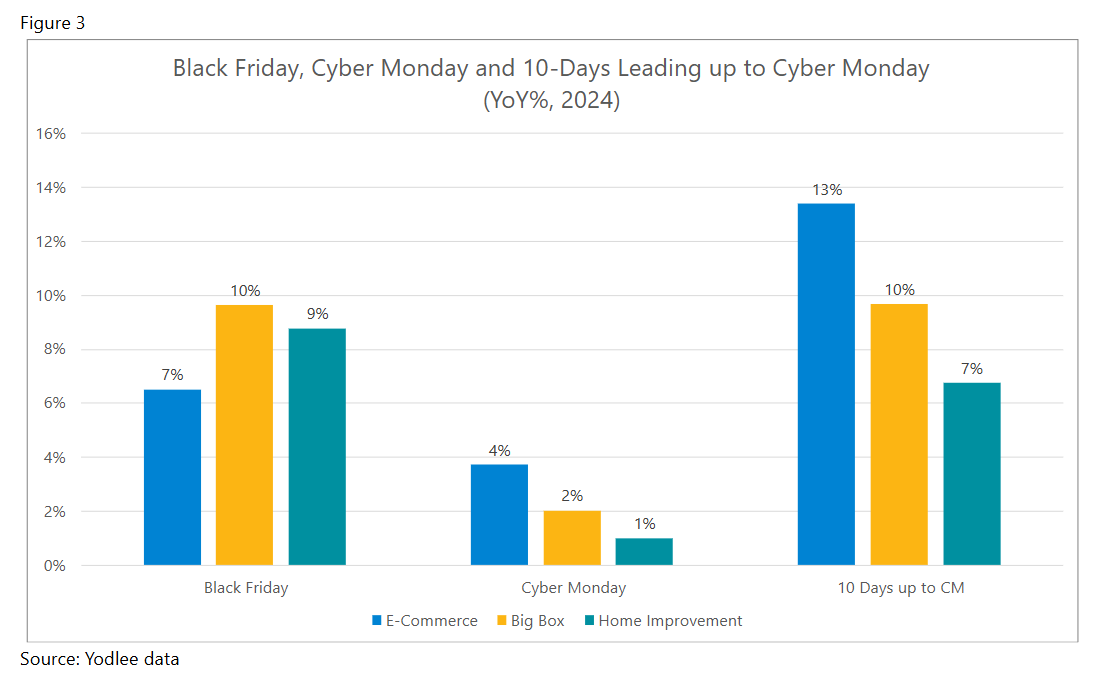

Yodlee data reveals that all three major spending categories experienced healthy YoY increases during the 10 days leading up to Cyber Monday. E-commerce saw the largest growth, as consumers embraced online shopping and spread out their Black Friday spending.

Big box retailers also showed strong YoY performance, with spending up 10% both on Black Friday and over the extended discount period.

Even home improvement, an area that has been saddled by high interest rates, achieved solid YoY gains with spending rising 9% on Black Friday and 7% over the 10-day period.

E-Commerce Shatters Records, Redefining Black Friday Shopping

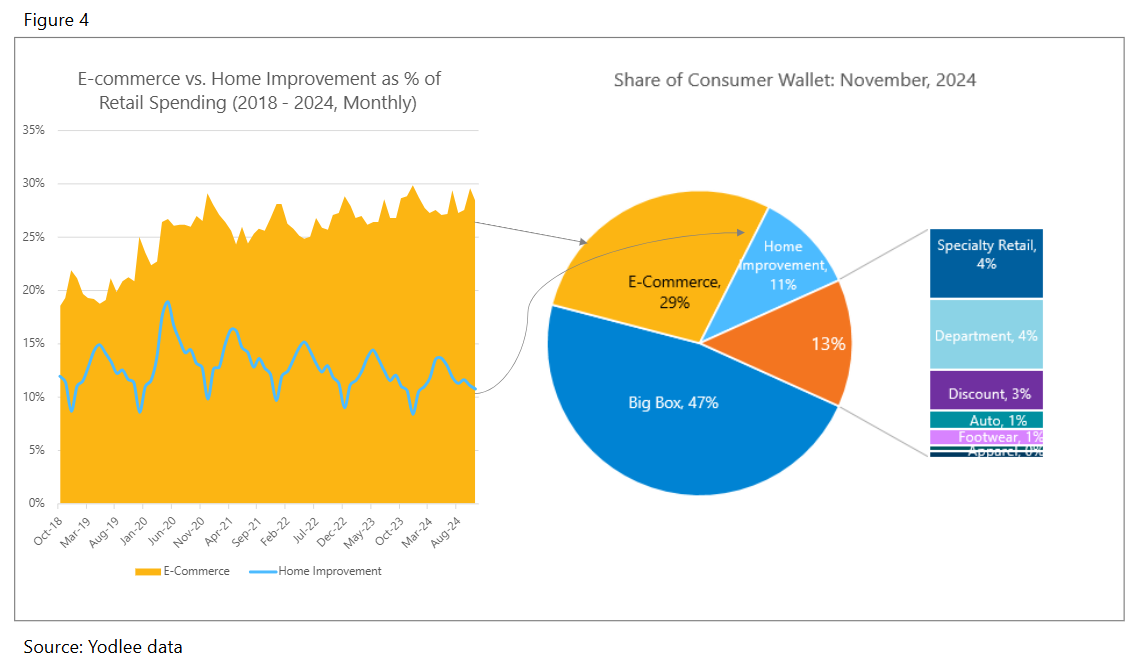

While big box retailers still commanded 47% of spending as of the end of November, Yodlee data highlights a growing preference among to avoid the Black Friday crowds and shop online.

E-commerce’s share of retail spending has risen significantly—from 18% in 2018 to 27% on Black Friday this year and 29% for the entire month of November (see Figure 4). It’s worth noting that these figures may understate e-commerce’s true impact, as they primarily reflect "pure" e-commerce brands and exclude online sales from traditional retailers.

Meanwhile, home improvement has seen its share decline, likely due to the higher interest rate environment prompting consumers to moderate their spending in this category compared to others.

This Holiday Season is Poised to Break Records Following Black Friday Surge

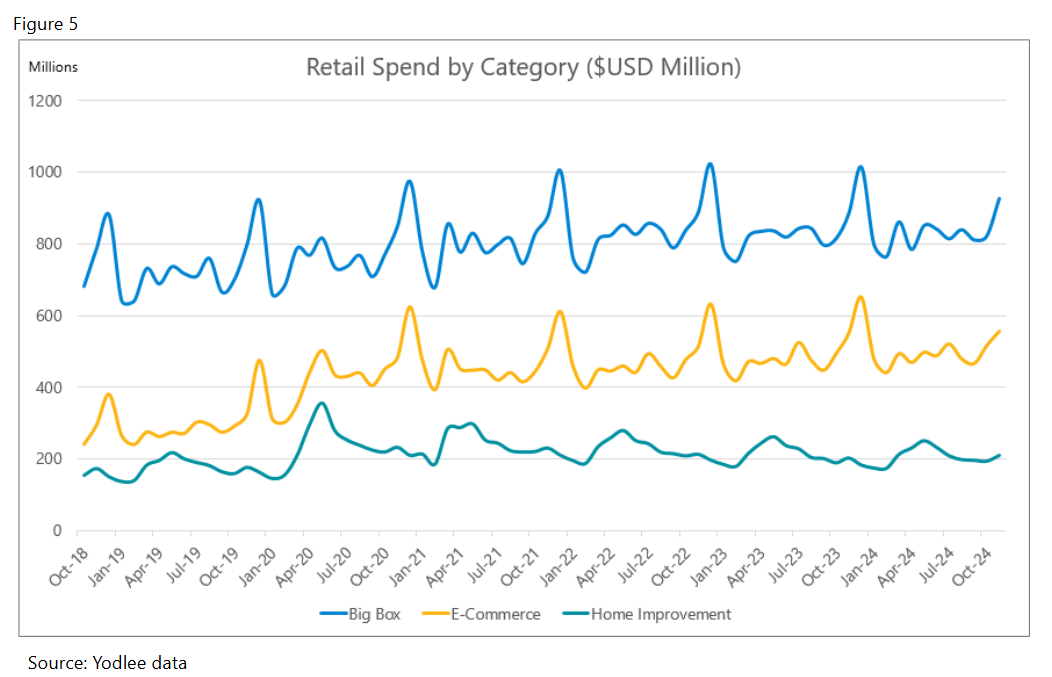

If Black Friday is any indication, the 2024 holiday season is on track to be exceptionally strong. All three major spending categories—e-commerce, Big Box, and home improvement—are showing significant momentum as shoppers transition from Black Friday bargains to last-minute holiday purchases (see Figure 5).

This data offers valuable insights for investors, highlighting broad consumer trends and pinpointing the brands that resonate most with shoppers. These trends will be key to identifying the companies best positioned for growth in the competitive retail landscape.

Want to see how transaction data can inform your investment process?

Learn more about Yodlee Merchant and Retail Insights and get a free demo from a sales representative.

About Yodlee Merchant, Retail, Shopper, and Spend Insights

Yodlee Merchant, Retail, Shopper, and Spend Insights utilize de-identified transaction data from a diverse and dynamic set of data from millions of accounts to identify patterns and context to inform spending and income trends. The trends reflect analysis and insights from the Yodlee data analysis team. By combining data with intelligence – connecting vast amounts of actual de-identified shopping data with state-of-the-art analytics and machine learning – Yodlee provides visibility into a large set of shopping daily purchase behavior including, but not limited to, transactions, customer lifetime values, and merchant/retailer shares.