Originally posted in The Financial Brand Bank and credit union executives more than ever need to keep up with fast-changing technology. Dozens of tech trends could be listed, but experts emphasize the importance of the five covered in this report. While not every institution will be impacted equally, collectively the trends point to where banking is headed. Where once banks and credit unions routinely left technology to specialists, the subject now has become elevated to the highest-ranking issue impacting retail banking. Research by The Economist Intelligence Unit (EIU) for Temenos finds that coping with new technology is the top concern of retail bankers, ahead of changing consumer behavior, political and economic instability and dealing with bad loans, among other factors. No institution can afford to ignore the combination of new competition from fintechs and big technology companies, multiple new technologies, and soaring consumer expectations is bringing unprecedented change to retail banking that And few are ignoring it, as the EIU survey indicates. However, the how quickly and how extensively organizations respond varies sharply by institution and sometimes even by country. In a study of 161 publicly traded banking institutions around the world, Accenture found that just over half are “digital laggards,” with no plans to go digital or just “half-hearted efforts.” About 40% are digitally active, doing many things right but still lacking true institutional commitment to digital transformation. Just 19 financial institutions (12%) from the group studied were “fully committed to transforming themselves into digital-centric institutions,” according to Accenture. The following five technology trends collectively signal that the transformation in what it means to be in the banking business is far from over.

1. Open Banking and Banking-as-a-Service: More Than an EU Issue

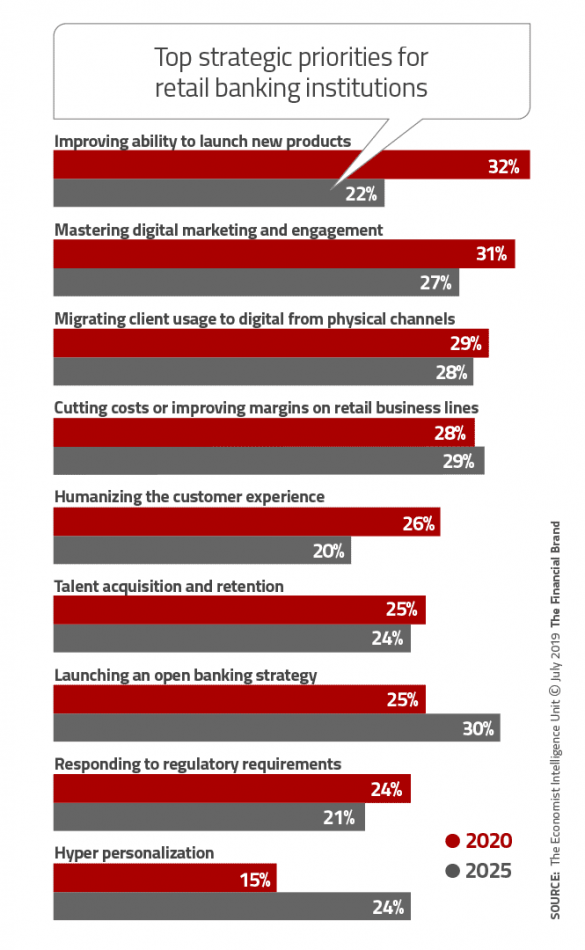

Many financial institutions, particularly in the U.S., view open banking as a European issue. Some also see it as threat — and in a way it is — to traditional business practices. This viewpoint isn’t helped by the fact that the terminology is confusing. Terms such as “open banking,” “banking-as-a-service,” “banking-as-a-platform,” “open APIs,” “API banking” and “ecosystem banking” are often used interchangeably — incorrectly because they are not all synonymous. As described in a BBVA blog, banking-as-a-service (BaaS) is an API (application programming interface) strategy that falls under the broader umbrella of open banking. “Generally, open banking refers to any initiative by a bank to open its APIs to third parties and give those third parties access to the bank, whether that be access to data or access to functionality.” While it’s true there are no specific regulations in the U.S. duplicating the U.K. Open Banking initiative and the European Union’s Payment Services Directive (PSD2), which require financial institutions to allow third parties to have access to customer data, the underlying concept of transparency and giving consumers more control of their data is a growing focus at multiple governmental levels. It’s also a competitive consideration — a good example being the difference in approach to handling consumer data used by Apple versus Facebook and Google. The concept of open banking in its broadest sense encompasses the need for banks and credit unions to respond to consumer demands for simple and painless experiences, whether that be to buy a home, pay another person or get paid, or manage their financial lives. Fintechs and big tech companies already are leveraging the new open API ecosystem to offer financial services. And while most financial institutions don’t have the capability to duplicate what Amazon and Facebook do, there are steps they can take, one of which is to partner with a fintech provider. Going even further, data from the Temenos/EIU survey indicates that more than four out of ten (41%) retail banking executives see their institutions’ digital business model evolving to be a true digital ecosystem in which they would offer their own and third-party banking products to their own customers and to other financial services providers. That may seem like blue sky to many in the industry. However, as shown in the chart, launching an open banking strategy — the number seven priority now — is expected to be the top priority by 2025 among the largest segment of banking executives at 30%.

Closely Related Trend: Security. The movement to increasing partnerships with fintechs and other parties means financial institutions will have to simultaneously implement even stronger forms of authentication and data protection measures than they currently use. In its Banking Technology Vision 2019 report, Accenture considers security as one of four major trends. “As the spider web of interconnectivity grows,” the report states, “the potential points of weakness and vulnerability also multiply.” The firm found that despite a clear trend toward open banking, only half (51%) of banking executives surveyed believe customer trust in partners their institutions use is extremely important. Even more startling, Accenture found that only 31% of banking execs know for a fact that their third-party partners are working diligently on security issues. The rest “trust and hope” that is the case. That lack of certainty must change, the firm maintains.

2. Always-On, ‘Invisible’ Banking

Many experts believe the business world is entering the post-digital age. Accenture sums it up in a banking context this way: “Despite all the talk of digital transformation, banking — like the rest of the world — is entering a post-digital age where the priorities of the last few years are fast becoming the table stakes of the future.” Capgemini refers to the trend as “invisible banking,” in which financial institutions seamlessly integrate financial services into consumers’ daily lives. In a way, the concept, like most in business, is not completely new, direct deposits being an example of an invisible transaction. But now the scope is far greater and the speed much closer to immediate. Technology has created an always-on world, where business opportunities appear quickly and evaporate just as quickly. Accenture mentions how auto insurance can now be bought by the mile or by the hour; how Alibaba can provide Chinese businesses micro-loans within minutes to finance working capital for only a few hours, and how Rocket Mortgage can offer initial mortgage loan decisions in as little as eight minutes.

“Nearly nine in ten banking executives agree that always-on capability will underpin future competitive advantage. Yet a mere one in ten are prioritizing on-demand delivery.” — Accenture

“The bar is being raised to the point where being competitive will mean not only having the right products and services but being able to recognize the exact point in time when they are needed,” Accenture states. Its research finds that nearly nine in ten banking executives (87%) agree that this always-on capability will underpin future competitive advantage. Yet only 38% say their institution is prioritizing a customized approach to delivering products and services. A mere 9% are prioritizing on-demand delivery.

Closely Related Trend: 5G Network Rollout. Mobile providers are racing to implement 5G service, the next-generation communication technology, reported to be anywhere from 10 to 100 times faster than 4G LTE. Experts emphasize that 5G capabilities will have an major impact on banking, and will also be used by fintechs to enhance their service offerings. Accenture reports that 55% of banking executives believe 5G will have a significant impact on their industry within one to three years.

3. Intelligent Assistants and Voice Banking

The rapid consumer adoption of voice assistants and digital assistants makes it imperative for all banks and credit unions to seriously consider implementing such a service. Some statistics help build the case:

- The number of smart speakers (e.g. Amazon’s Echo and Echo Dot) in use in the U.S. grew 78% in one year to 118 million, according to NPR and Edison Research.

- Juniper Research predicts there will be 8 billion people using digital voice assistants (Siri, Cortana, Alexa, etc.) by 2023.

- Bank of America’s digital assistant Erica, used by more than seven million of the bank’s customers, handled 50 million interactions in its first year.

- Nearly one quarter of retail banking customers today prefer to use a voice assistantinstead of visiting a physical location, according to Capgemini, which predicts this figure will jump to two out of five in three years.

A handful of large banks have invested heavily in digital assistants, including BofA, Capital One, U.S. Bank, USAA and Barclays, as well as some smaller institutions such as Mercantile Bank of Michigan. However, research by Cornerstone Advisors among mid-size banks and credit unions finds that only 2% of the responding institutions have deployed chatbots, 13% are planning to invest in it in 2019, 45% are discussing the possibility, and 41% don’t have it on their radar at all. Clearly the potential of artificial intelligence-powered digital assistants remains largely untapped in the banking space. PwC notes that 80% of consumers are comfortable using voice to shop. That’s not the same thing as banking, to be sure, but with the use of voice authentication, fingerprint, or other biometric technologies, the industry can find the right way to integrate voice banking to enhance the consumer experience. Some experts believe that in the next five years, 50% of all banking interactions will be via voice-first devices.

4. AI-Driven Personalization Still on the Do List

Bank and credit union executives could be forgiven if they felt like artificial intelligence and the closely related subset, machine learning, have been rammed down their throats. While understandable, anyone who simply tries thinking like a consumer will recognize the power of personalization. Just do a Google search and then compare the almost magical results to how easy it is to find what you want on your institution’s or your competitor’s website. Putting it a bit more elegantly, “The ability to observe, catalog, analyze and interpret the actions of bank customers (while also respecting their privacy) allows the design and delivery of rich, individualized experiences that will build customer loyalty in the post-digital age,” Accenture states. Many use cases currently revolve around card-based fraud prevention, but increasingly the ability to predict that a consumer will overdraw and for the institution to automatically reschedule the bill payment date will come to be expected by consumers. Several so-called challenger banks offer this type of capability, as do some larger financial institutions. And the prospect looms that one of the big tech firms could take their massive AI capability and apply it directly to financial services. That’s why it’s crucial for banks and credit unions to take steps on their own, with partners or the right vendors, to be able to “delight customers,” as Accenture puts it, “by helping them optimize their spending, giving them preferred access to better deals and nudging their behaviors in ways that create better long-term financial health.” Already 26% of retail banking execs globally are focusing their digital investments on AI applications, the Temenos/EIU study notes. That’s third behind cyber security (39%) and cloud-based technologies (35%). The top-ranked used for AI, among the same group, is “improving user experience through greater customer personalization.” One AI challenge is finding the right balance between proactive insight and intervention and privacy. Studies show that consumers are willing to share more information with their banks in return for highly personalized and relevant offers and service. In a global survey, Capgemini, for one, says 44% of banking consumers feel that way about sharing personal data with their banks. It may be the early stages of AI use in banking, particularly in terms of personalization, but many feel there is urgency now to begin the process of building required expertise, data consistency and, of course, the necessary technological capabilities.

5. Enhanced Employee Skills for Digital-First Banking

New technologies impact bank and credit union workforces as much as they do the consumer and business customers they serve. The expected conclusion from that point is that financial institutions will have to retrain or replace their workforce. Actually it’s closer to the other way around. One of the interesting findings in Accenture’s Vision research is that three quarters of the retail banking executives polled believe their “employees are more digitally mature than their organization, resulting in the workforce ‘waiting’ for the organization to catch up.” The real risk: If the institution doesn’t catch up, these valuable workers will move on. In the cases where the financial institution does invest in some of the technologies described here, Accenture predicts that banking employees will become increasingly empowered by a combination of their own skill sets and knowledge plus technology tools ranging from learning platforms to AI decision support. This transition can be seen clearly in several areas of banking, notably the impact of regtech to assist in meeting demanding compliance regulations, and martech used in financial marketing. Regarding the latter, the rise in importance of marketing operations and marketing technology job functions is symptomatic of what is, or will be occurring throughout the institution. Overall, Accenture finds that the rate of workforce change in retail banking will accelerate rapidly. Over the past three years, just 11% of executives of retail banking brands globally say that a majority of their institution’s workforce transitioned into new roles requiring new skill sets. Within the next three years, however, 43% of these executives believe a majority of their workers will need new skills. Tellingly, eight out of ten of these banking leaders foresee increased employee velocity — the speed at which employees move between roles or organizations.