How Pension Data Drives Intelligent Financial Planning

While open banking has transformed the financial services industry, one of the sectors left behind is pensions.

That’s because pension data isn’t included in the scope of open banking-enabled financial data that consumers are able to access and share with third-party providers through APIs. Here’s why that’s cause for concern:

Pensions are one of the largest and most important investments consumers contribute to in their lives. Yet research from the Financial Conduct Authority (FCA) shows that most people never switch pension funds, and many don’t receive timely advice in the years or decades before retirement. To underscore the cause for concern, half of the consumers surveyed by the FCA admit to being totally disengaged when it comes to pensions.1

Is there a solution, and if so, what is it?

Consumers need to be able to access and share their pension data easily to receive strategic guidance on pension contributions, withdrawals, and retirement. At Envestnet | Yodlee, we’re doing just that. We're one of the only data aggregators in the UK that can access pension data for some providers.

The UK government is working on a Pensions Dashboard Programme, which we support and look forward to being more deeply involved with. This programme is designed to allow people to find lost pensions and view data about their pensions in one place. Though currently the programme has been delayed due to capacity and capability issues, and the coverage that it will be able to provide hasn’t been finalized.

We also support the work of the Joint Regulatory Oversight Committee (JROC), and will continue to do so as JROC considers further industry input on the next phase of open banking in the UK. In order for the maximum potential of pension data to be realised, we need help from the government and regulators to ensure pension data is unlocked.

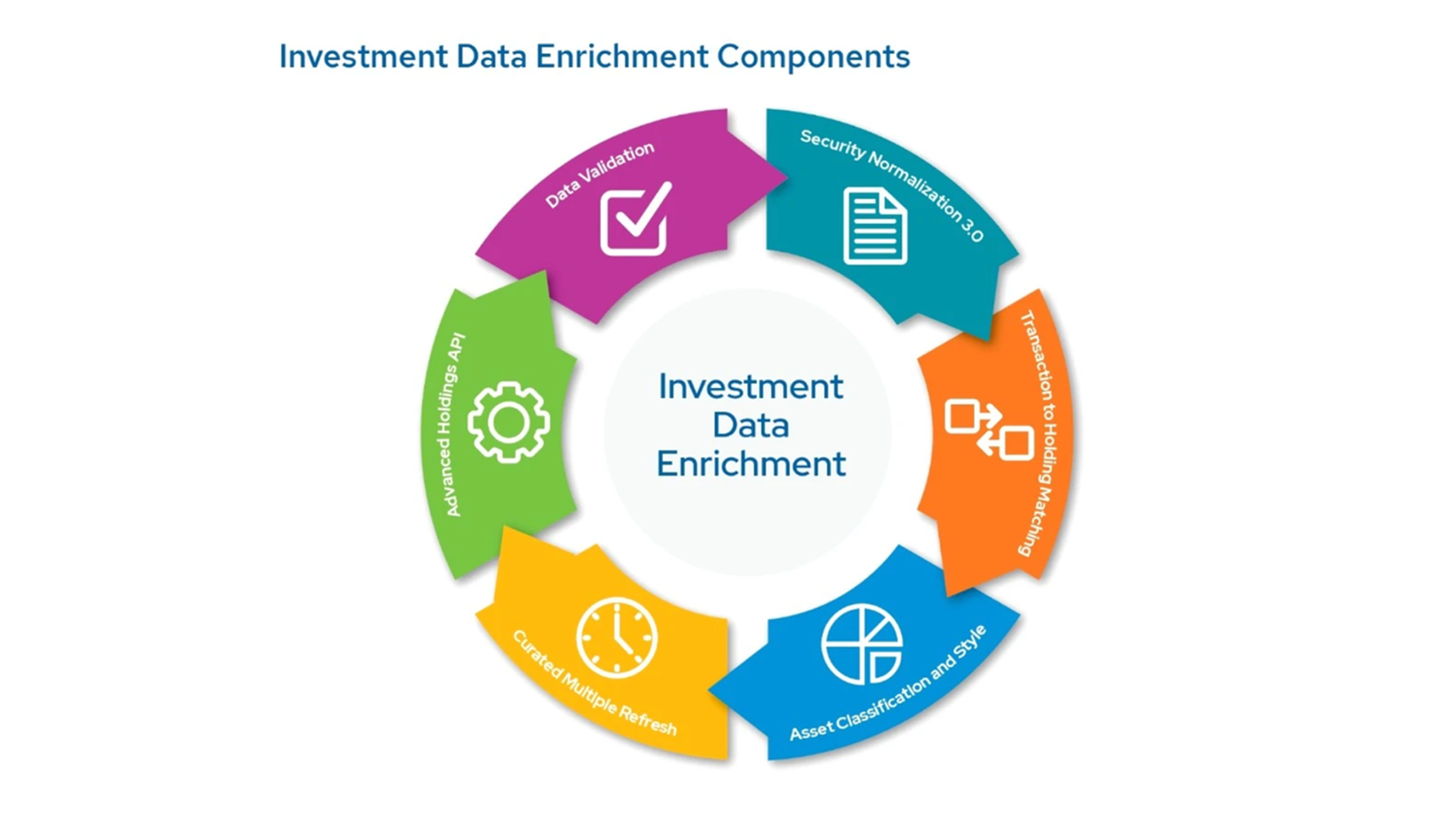

Meanwhile, we’re connecting our consumers to pension data right now, and we offer a variety of solutions that work with pension data, such as Transaction Data Enrichment, which helps to clarify investment data and makes it easier to identify investors’ positions, deliver meaningful recommendations, and power better data analysis.

We also have a Net Worth Tracking app. This app enables users to see exactly how much money is available across all of their accounts. With this comprehensive view, financial service providers can actively engage with and advise their clients throughout every step of their financial journey.

By fully utilising pension data today, financial service providers can help consumers plan for a more vibrant financial future. If you’d like to learn more about integrating pension data into your financial apps and services, send our team a quick note.

Read the first article in this Pension Data series

| Consumer-Permissioned Data | Accessed by Envestnet | Yodlee | Commonly Accessed by Other Aggregators |

|---|---|---|

| Pension data | Yes | No |

| Banking data | Yes | Yes |

| Transaction data | Yes | Yes |

| Investment holdings | Yes | No |

| Credit card data | Yes | Yes |