Data Aggregation

Disrupt With The Best Data Aggregator

As the market leader in financial data aggregation, Envestnet | Yodlee can help you grow from startup to success. Our APIs deliver data from over 17,000 global data sources, so you can easily get the bank, credit card, investment, loans, rewards, and financial account data you need. The possibilities are infinite.

Data Aggregation Technology

Key Benefits of Our Data Aggregation

You can use our APIs for everything from financial wellness and wealth management to credit and lending.

Up-to-Date Data

Data dynamically populates ensuring you have access to up-to-date information at all times

Bank-Level Security and Compliance

Yodlee's account aggregation software adheres to best practices for security, risk, compliance and consumer privacy

Unparalleled Global Data Sources

More than 17,000 global data sources give you access to de-identified data analytics and insights

Data Enrichment

Get a market-leading advantage by leveraging our data enrichment tools for the most accurate insights

Easy Integration & Mitigate Risk

Our intuitive API makes it easy to get things up, running and then continue scaling. Make data-driven, impactful financial decisions by having critical data at your fingertips.

Open Banking & PSD2

As a licensed Account Information Service Provider, we can help you satisfy UK open banking requirements and integrate with open banking and PSD2 compliant accounts.

Automated Financing

Case Study for Automated Transactional Data

Kabbage and Envestnet | Yodlee have created a solution using Data Aggregation and bank Account Verification. We are the primary financial data source Kabbage uses to review and run financials, in order to evaluate and enable instant underwriting for a line of credit or a financial products customer.

Get to Market Faster

Aggregation API

Access financial data simply and securely with the Envestnet | Yodlee Platform. The intuitive API architecture, reduced code requirements, and simplified data model make it easy to integrate with our platform.

Innovate With the Best Data

With our APIs, you’re not getting just any data, you’re getting accurate data that has been cleaned, enriched, and categorised with Envestnet | Yodlee Transaction Data Enrichment.

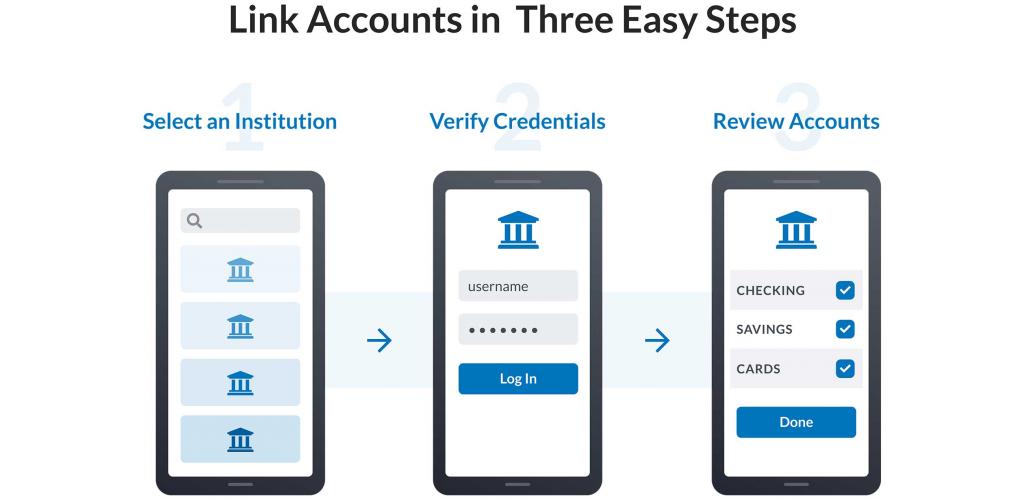

Link Financial Accounts in Near Real-Time

By integrating the Envestnet | Yodlee APIs with FastLink, consumers can link their accounts on any device within seconds. This speedy and intuitive process integrates UX best practices from decades of experience keeping customer conversion top of mind.

Give Yourself Room to Grow

Use our financial data APIs to gain simple, flexible access to the Envestnet | Yodlee Financial Data Platform to meet your aggregation needs now – and add or expand use cases as your business needs evolve.

Have a True Developer Experience

Integrate, build, launch, and scale disruptive solutions with the Envestnet | Yodlee developer experience. Leverage the most comprehensive and accurate data in the market in category accuracy and reconciliation for FinTech and wealth use cases. Benefit from the world’s most comprehensive data coverage, pulled from 17,000 global sources, including Open Banking support, and delivered at faster speeds by our finely tuned Platform API. Developers can start for free in the U.S. and U.K. for up to 100 users and/or verifications.

What is Account Aggregation?

Account aggregation is a key aspect of business intelligence, allowing companies to analyse and draw critical insights. For the consumer, it's the ability to bring together information from multiple accounts, tools, and institutions in order to get a 360-degree of their finances and make better spending and saving decisions. Data can be aggregated from bank accounts, credit cards, brokerage accounts, and more.

Financial aggregators like Envestnet | Yodlee provide FinTech firms and financial institutions with API that enable consumers to seamlessly bring their account information into one system.

Learn More About Envestnet | Yodlee Data Aggregation Products

Bring consumer account information under one roof.

Get a 360-degree view of consumer assets.

Get a consolidated view of consumer holdings and an in-depth look at individual stocks.

Understand all consumer investments to make better recommendations.

What is Data Aggregation?

Data aggregation is the process of pulling data from a number of different sources. Through data aggregation, financial service providers and FinTechs can securely leverage comprehensive and accurate data for personalized financial apps and services. With data always up to date and immediately available online, there’s no need for manually updating, gathering, or filing data, which saves time and energy. De-identified transaction data based on diverse and dynamic sets of data can also be presented in a summarised format for statistical analysis.

What is Account Aggregation?

Account aggregation, also known as financial data aggregation, is a key aspect of business intelligence, allowing companies to analyse and draw critical insights. For the consumer, the benefit of account aggregation is the ability to bring together information from multiple accounts, tools, and institutions in order to get a 360-degree of their finances and make better spending and saving decisions. Data can be aggregated from bank accounts, credit card accounts, brokerage accounts, and more. Financial aggregators like Envestnet | Yodlee provide FinTech firms and financial institutions with API that enable consumers to seamlessly bring their account information into one system.

Get Started With Financial Data Aggregation

With our financial data aggregation APIs, we connect you to the most comprehensive and accurate data in the market for FinTech and financial services.

Get Started