- What is Open Banking?

- Innovative Open Banking APIs

- Examples of Open Banking Done Right

- Turn Open Banking Into a Competitive Advantage

- Championing Open Banking Worldwide

What is Open Banking?

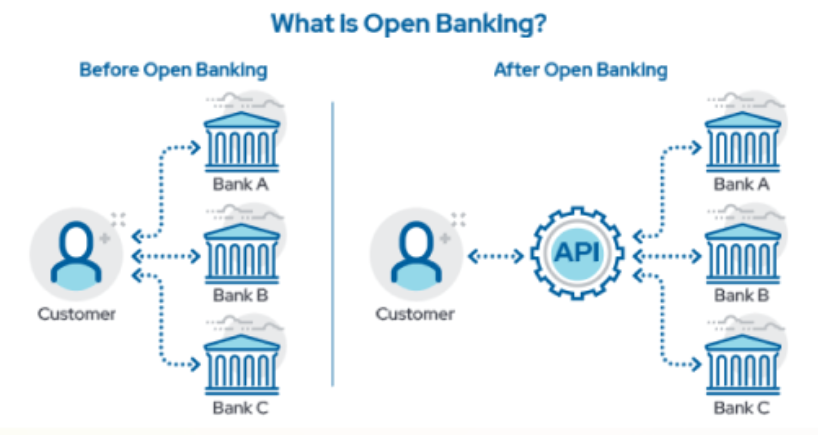

Open banking refers to the consumer’s right to share their financial data with trusted third-party financial service providers. The open banking data-sharing movement increases opportunities to create and deliver innovative financial wellness products and services, while establishing uniform security standards for data access, transparency around data usage, and user-based permission and control. Instead of sharing banking credentials and usernames and passwords, open banking empowers consumers and their financial institutions to seamlessly share data via open APIs.

Financial service providers in the US are gearing up for the new era of open banking. This transformative legislation will mandate that consumers have greater control over their financial data, compelling financial institutions and fintechs to adopt secure and transparent data-sharing practices.

To stay ahead, providers need to develop robust APIs, ensure compliance with data privacy regulations, and enhance their cybersecurity measures. Embracing these changes not only fulfills regulatory requirements but also presents a unique opportunity for financial service providers to innovate, improve customer experiences, and gain a competitive edge in the evolving financial landscape. Envestnet | Yodlee, as a leading data aggregator, can provide the tools to help you navigate and thrive in this new environment.

Innovative Open Banking APIs

Open banking APIs facilitate secure, direct connections with internal bank systems, enabling financial data to be shared safely and efficiently. These APIs expose internal data structures in a controlled manner, allowing third-party developers to innovate rapidly within a secure environment. The comprehensive API platform includes essential tools such as sample code, a custom portal, an extensive API library, and community assets, all designed to accelerate the development process.

By leveraging these APIs, financial institutions and technology companies can create new applications and functionalities while utilizing open-source data analytics to enhance the customer experience. These APIs support rapid market deployment, ensure regulatory compliance, and uphold stringent security standards, empowering banks, financial institutions, and non-banking innovators to offer more competitive services and a broader range of choices for consumers.

Examples of Open Banking Done Right

Delivering a Holistic View

Open banking is at the core of financial well-being solutions offered by companies like 22seven. That’s because open banking API connections enable account aggregation, which allows users to see their assets, debits, and other account information from multiple providers, all in one place. Prift also relies on open banking data connections to provide personalized financial guidance and product recommendations to help users make more informed financial decisions

Empowering Financial Management

Through open banking APIs, companies like Moneysoft are able to leverage consumer-permissioned data to help consumers automate household finances and save for the future. By pulling in data from outside open banking systems into a personal financial management platform, Moneysoft helps consumers budget, track their net worth, and receive professional assistance from financial advisors.

Streamlining Lending

Acquiring a holistic picture of a potential borrower’s spending and income history and conducting credit analysis is typically time-consuming and labor-intensive. But open banking APIs can provide quick access to financial account information for an up-to-date and more detailed picture of credit applicants, which can speed up the data analysis process and enable more accurate and efficient credit decisions.

Turn Open Banking Into a Competitive Advantage

Enhanced Customer Experience

Open Banking enables financial service providers (FSPs) to offer personalized financial services by providing customers with tailored recommendations, seamless account integration, and advanced financial management tools. Yodlee’s robust data aggregation and analytics solutions help FSPs to gain a comprehensive view of customer finances, facilitating the delivery of highly relevant and timely financial advice. This enhanced customer experience can not only boost satisfaction and loyalty but also position FSPs as trusted advisors in their customers' financial journeys.

Data-Driven Insights

Access to comprehensive financial data through Open Banking allows FSPs to gain deeper insights into customer behavior and preferences. Yodlee’s advanced data analytics capabilities can help FSPs turn raw data into actionable insights, empowering them to craft more effective marketing strategies, optimize risk assessment, and enhance decision-making processes. These data-driven insights enable FSPs to anticipate customer needs, tailor their services accordingly, and maintain a competitive edge by making informed, strategic decisions.

Innovative Product Development

By leveraging open APIs, FSPs can rapidly develop and deploy new financial products and services, staying ahead of competitors in delivering cutting-edge solutions. Yodlee’s API platform provides essential parts of the necessary infrastructure, sample code, and tools to streamline the development process, enabling FSPs to innovate quickly and efficiently. This agility allows FSPs to meet evolving customer needs with unique offerings, differentiating themselves in a crowded market.

Regulation

Open banking is well underway in Europe due to regulations like PSD2, but is a developing ecosystem in the United States. The passage of Section 1033 is set to change this by establishing uniform standards that third-party providers must follow. This new regulation will ensure reliable, consistent, and uniform access to consumer-permissioned financial data. Yodlee is at the forefront of this evolution, offering comprehensive API platforms that adhere to emerging standards and best practices, ensuring that financial institutions can provide effective and compliant open banking services even in a changing regulatory landscape. You can read more about it, here.

Yodlee’s Global Open Banking Footprint

Open banking is rapidly becoming a global trend, with Europe leading the way through the implementation of PSD2, setting a benchmark for seamless and secure access to financial information. Other regions are learning from Europe’s example and from each other, establishing best practices and frameworks to enhance financial data sharing. This collaborative global movement is transforming the financial services landscape, making it more interconnected and consumer-centric.

Yodlee is positioned to support financial institutions and fintech companies in this evolving landscape. Yodlee’s extensive experience and robust technology infrastructure enable it to provide reliable and compliant data aggregation services across multiple regions. By partnering with Yodlee, financial institutions can seamlessly integrate open banking solutions which can help ensure they stay ahead of regulatory changes and leverage the full potential of open banking. Yodlee’s comprehensive global reach and commitment to innovation make it the go-to partner for institutions looking to harness the benefits of open banking worldwide.

Championing Open Banking Worldwide

Envestnet | Yodlee has been at the forefront of the global open banking movement, advocating for consumer access to their financial data. As a founding member of the Financial Data Exchange (FDX) in the US and the Financial Data and Technology Association (FDATA) in the US, UK, and Australia, Yodlee is dedicated to setting industry standards that promote transparency and accessibility. Yodlee is also a member of the FCA’s Future Entity Working Group, which is creating the next standards for open finance in the UK.

Our commitment is demonstrated through our direct partnerships with some of the world's largest financial institutions. By working collaboratively, we aim to make financial data open and accessible, empowering consumers to take control of their financial futures. Envestnet | Yodlee's leadership and innovation are paving the way for a more inclusive and connected financial ecosystem.