Fast & Accurate Lending Decisions

Full Financial View

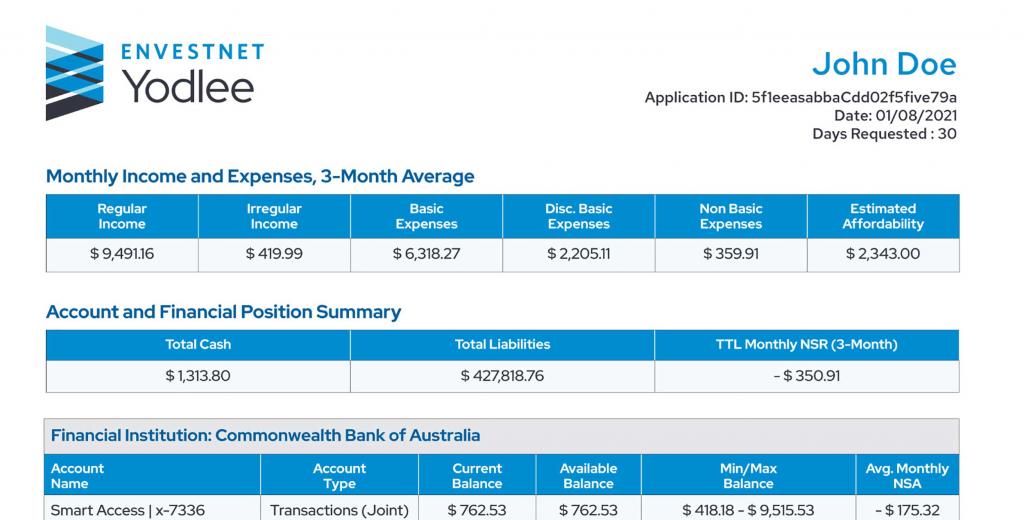

With Envestnet | Yodlee Credit Accelerator, you can enable consumers to connect their financial accounts to generate a comprehensive and accurate view of their financial position. Our industry-friendly holistic report includes income and expense summaries to inform and speed lending decisions whilst adhearing Australia’s and New Zealand’s Responsible Lending guidelines.

Credit & Lending

With Envestnet | Yodlee’s proven technology, banks and FinTechs can instantly aggregate, categorise, and display consumer income and expense analysis for faster more accurate lending decisions.

Comprehensive Picture

Get an accurate and complete view of an applicant’s financial position from aggregated account data

Instant & Accurate Results

Digital data retrieval and analysis reduce manual errors, cut operational costs, and reduce decisioning times

Expense & Income Analysis

Comprehensive report includes income and expense summaries for Responsible Lending decisions

Real-Time Picture

Current financial account data is aggregated and analysed for an up-to-date view

How It Works

Empower Lending with Instant Analysis

Acquiring a full picture of a potential borrowers’ spending and income history and conducting credit analysis is typically a time-consuming and labour-intensive process. But with Envestnet | Yodlee’s Credit Accelerator, you can use our proven data aggregation capabilities to gain a complete picture of your credit applicants and speed the data analysis process without compromising the results.

Here’s How It Works:

- Integrate with Envestnet | Yodlee’s Financial Data Platform and Envestnet | Yodlee FastLink so your customers can add and link their financial accounts

- Your customers grant permission and link their financial accounts

- You receive a comprehensive report via a PDF or data extract format

All the Details at Your Fingertips

Expense and Income Analysis

Credit Accelerator report includes an income summary, which delivers detailed information on all sources of income and recurring income streams. It also includes an expense summary, which classifies spending into industry-friendly categories (or custom categories as required by each lender’s own decisioning framework) to help you identify key credit risk and lifestyle factors.

Whitepaper

Leverage Technology to Facilitate Responsible Flow of Credit

Responsible lending requires banks to understand consumers’ financial data to better assess their financial position. The right technology – for the financial institution and the consumer – can help to bring this together quickly and easily.