Envestnet | Yodlee Transaction Data Enrichment

Clean & Accurate Transaction Data

Envestnet | Yodlee Transaction Data Enrichment turns ambiguous transaction information into clear, easy-to-use contextualised data, allowing financial institutions to extract deep insights into customer needs and behaviors while enabling them to improve the customer journey and drive more meaningful interactions.

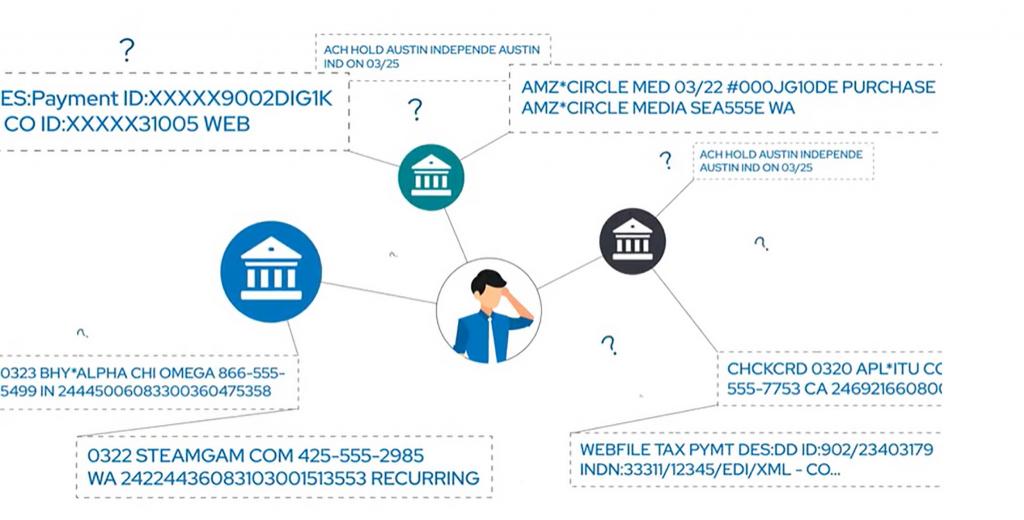

Uncover the Meaning Behind Transactional Data

Key Benefits

Consumer transactions are the most insightful data that institutions can harness to learn about their customers, and Envestnet | Yodlee makes it easier to understand.

Machine Learning

Data science algorithms provide the most accurate classifications and clear, concise, easy-to-use transaction data

Offer Personalised Finance

Utilize data insights to craft offers, increase engagement, drive conversion, and provide impactful financial wellness solutions

Transaction Data Analysis

Leverage clean data to deliver custom data-driven financial advice while driving down costs in call centres and service organisations

Accurate Share of Wallet

Gain rich insights into customer share of wallet and spending behaviour

Clarified Transactions Categories

Our transaction service clarifies unidentifiable purchases to decrease support and fraud research costs

Open Banking Provider

As an Accredited Data Recipient and Intermediary under Australia’s Consumer Data Right (CDR), we offer trusted access to data per CDR and open banking requirements

Transaction Data Enrichment Video

Sort, Enhance, & Normalise Data

Transaction Data Enrichment turns ambiguous transaction information into clear, contextualised data using sophisticated artificial intelligence and machine learning to achieve industry-leading accuracy across a wide range of account and transaction types.

The power pf personalisation

Leading the Industry in Data Enrichment

As the leading aggregation platform that owns the aggregation process from acquisition to delivery, Envestnet | Yodlee’s aggregation process incorporates over 17,000 data sources and touches over 22 million active users.

Most Comprehensive Data Coverage

The unique combination of breadth and depth provides Envestnet | Yodlee with the largest, most comprehensive data coverage in the industry. When paired with our sophisticated machine learning techniques, the result is a highly enriched set of digitised transactions which leads the industry in transaction categorisation accuracy.

Clear Merchant Transaction Data With Context

With Envestnet | Yodlee Transaction Data Enrichment, consumers not only see a clear merchant name, date, and amount, but they also get additional context—including a simple description of the transaction and category. The information is categorised and contextualised based on the learnings from billions of transactions contained in the Envestnet | Yodlee Financial Data Platform.

Yodlee Transaction Enrichment is available through Envestnet | Yodlee’s fully hosted FinApps series and API.

Adding Value with Transaction Categorisation

Financial data, when categorised, provides deep consumer insights into spending behavior and enables the delivery of targeted offers and services. Financial service providers use transaction categorisation to offer a more customised and engaging online banking experience and deliver personalised financial advice. Lenders use the data to better understand customers who’ve been previously defined as high risk and identify potentially fraudulent behavior. Categorised transaction data is also invaluable for FinTechs building innovative apps and solutions that help consumers manage their money, increase financial wellbeing, and more.

Get Started With Transaction Categorisation

Drive meaningful digital insights and interactions with enriched and simplified transaction categorisation data.

Get Started