Build a Personalized Banking Experience with the Best Data & Analytics

Insights Solutions

Create personalized banking experiences built on actionable consumer insights, peer benchmarking, account aggregation, data enrichment, and business analytics.

Personalize with the Best Data, Analytics, and Insights

Insights Solutions

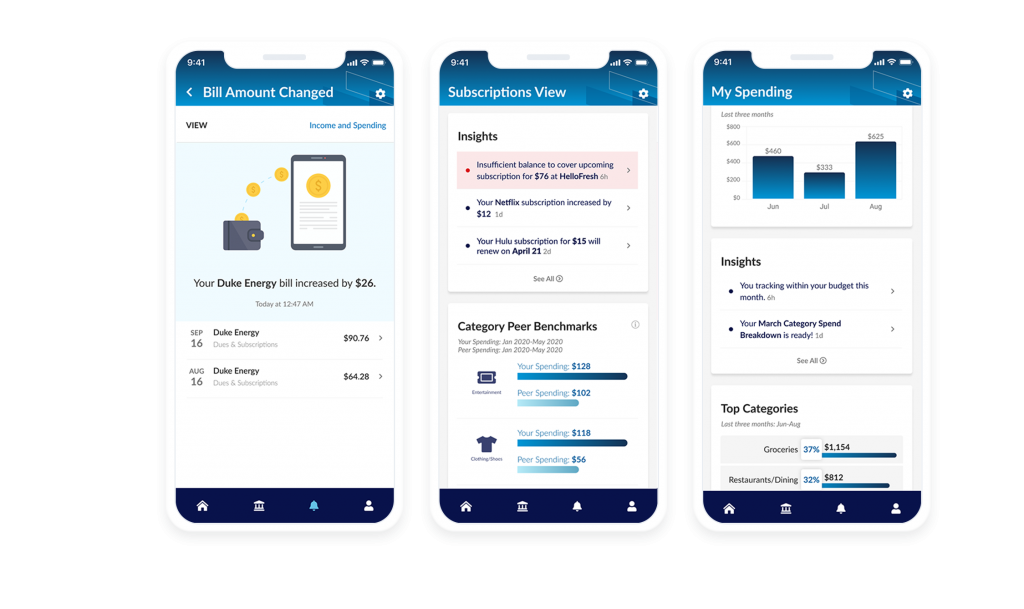

Envestnet | Yodlee Insights Solutions combine actionable consumer insights, peer benchmarking data, personalized views, and critical data needed for segmentation to enable contextual, hyper-relevant customer interactions.

The Data Advantage

Drive Business with Deep Insights

With today’s consumers expecting digital experiences and interactions to be relevant, insightful, and tailored to their needs, hyper-personalization isn’t just a nice-to-have, it’s the new baseline for success. With Envestnet |Yodlee Insights Solutions, you can engage, serve, and retain today’s consumers with the ability to apply Financial Insights APIs and build, implement, and scale the hyper-personalized financial wellness experiences consumers require.

Use Insights Solutions for:

- Actionable Insights: Uncover meaningful data points for your customers

- Peer Benchmarking: Add unique comparisons and create engagements

- Personalized Views: Help consumers learn, know, and act easily with financial snapshots

Benefits for Financial Institutions and FinTechs:

- Partnering with a provider who adheres to the highest standards of data transparency, security, privacy, and compliance

- An ever-expanding library of deep insights and unique comparisons

- Ability to identify new opportunities to deliver personalized experiences

- Convenient, all-in-one, comprehensive platform

- Personalized views to inspire development

- Industry-leading, high-quality, cleaned and enriched data

Benefits for Consumers:

- Hyper-personalized digital financial services and better financial planning

- Relevant and targeted offers based on unique needs

- Ability to compare financial behavior to peers

- Greater control and clarity of financial activity

- Secure digital experiences and services that build trust

Video

Insights Solutions Overview

Learn more about how Insights Solutions can empower financial service providers to deliver the innovative, hyper-personalized banking services that consumers demand. Tailored banking services use meaningful insights on spending, borrowing, saving and planning to foster financial wellness and drive loyalty among their customers. Financial service providers can apply, implement, and scale these flexible APIs to address common financial pain points.

eBook

Driving Customer Advocacy Through Hyper-Personalized Financial Experiences

In a world where brands battle for their very survival, the best – and even the only way to succeed is to foster customer loyalty by driving customer advocacy through hyper-personalized digital experiences. In this eBook, we’ll show how.

Personalization in financial services marks a critical frontier for the industry, and broader application of personalized services across sectors is accelerating consumer demand. These types of solutions signify an important leap forward by supplying financial service providers with the tools they need to provide high-quality, personalized customer experiences that can make a meaningful impact on their financial future